Exploring the realm of same-day auto insurance opens up a world of convenience and flexibility for drivers. This guide aims to shed light on the intricacies of securing immediate coverage, offering insights that can help you make informed decisions swiftly and effectively.

Delve into the following sections to unravel the mysteries of same-day auto insurance and empower yourself with the knowledge needed to navigate this aspect of the insurance landscape with confidence.

What is Same-Day Auto Insurance?

Same-day auto insurance refers to a type of car insurance policy that provides immediate coverage on the same day it is purchased. This option is ideal for individuals who need instant protection for their vehicles without waiting for the standard processing time.

Opting for same-day auto insurance can offer several benefits, such as:

Benefits of Same-Day Auto Insurance

- Quick Coverage: Same-day auto insurance ensures that you are immediately protected on the road, giving you peace of mind.

- Convenience: You can purchase and activate your policy on the same day, saving you time and hassle.

- Flexibility: It allows you to get coverage when you need it the most, especially in emergency situations.

Examples of Situations for Same-Day Auto Insurance

- Emergency Travel: If you need to travel on short notice and require insurance coverage for your rental car, same-day auto insurance can be a convenient option.

- Car Purchase: When buying a new vehicle and need immediate coverage before driving it off the lot, same-day auto insurance can provide the necessary protection.

- Loan Requirements: Some lenders may require proof of insurance before approving a car loan, and same-day auto insurance can help you meet this requirement quickly.

How to Get Same-Day Auto Insurance?

Getting same-day auto insurance is a convenient option for those who need immediate coverage. Here's a detailed guide on how to obtain it:

Process of Obtaining Same-Day Auto Insurance

- Research insurance providers that offer same-day coverage.

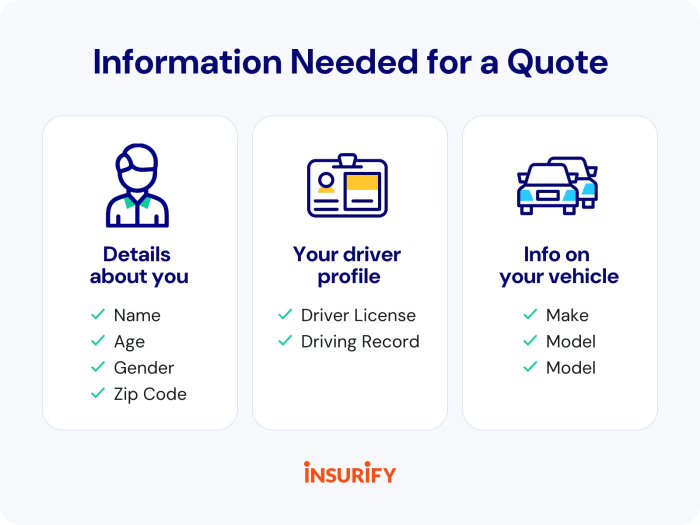

- Provide necessary information such as your driver's license, vehicle details, and driving history.

- Get a quote for the coverage you need and make the payment.

- Receive your insurance documents electronically or in person, depending on the provider.

Requirements for Traditional Insurance vs. Same-Day Insurance

When comparing traditional insurance with same-day insurance, the main difference lies in the speed of approval and coverage initiation. While traditional insurance may require more paperwork and processing time, same-day insurance offers immediate coverage with minimal documentation.

Tips for Expediting the Same-Day Auto Insurance Application Process

- Have all necessary documents on hand, such as your driver's license, vehicle registration, and payment information.

- Provide accurate information to avoid delays or rejections.

- Consider opting for basic coverage initially to speed up the process, and then upgrade later if needed.

- Choose reputable insurance providers known for their efficient same-day services.

Factors to Consider When Choosing Same-Day Auto Insurance

When selecting a same-day auto insurance provider, there are several key factors to consider to ensure you are getting the coverage you need at a price that fits your budget.

Coverage Options

- Liability Coverage: This is usually the minimum coverage required by law and helps cover costs associated with injuries or property damage you cause to others in an accident.

- Collision Coverage: This helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are in an accident with a driver who does not have insurance or enough insurance to cover your expenses.

Pricing Variations

Pricing for same-day auto insurance may vary compared to traditional auto insurance due to the expedited nature of the coverage. Providers may charge higher premiums for same-day policies to offset the increased risk of insuring a driver without a prior history with the company.

Importance of Same-Day Auto Insurance

Having access to same-day auto insurance is crucial in various situations, providing immediate coverage when needed. Whether you forget to renew your policy, purchase a new vehicle, or need quick coverage for unexpected circumstances, same-day auto insurance offers peace of mind and legal protection.

Emergency Situations

- Imagine getting into an accident and realizing your insurance policy has expired. Same-day auto insurance can help you get back on the road quickly and handle any damages or liabilities.

- In case you need to drive a friend or family member's car unexpectedly, having same-day auto insurance can prevent legal issues and ensure you are covered while behind the wheel.

Legal Compliance

Driving without insurance is illegal in most states, and penalties can range from fines to license suspension or vehicle impoundment.

- Same-day auto insurance ensures you comply with the law and avoid any legal consequences for driving uninsured.

- It provides immediate proof of coverage, which may be required in certain situations, such as registering a new vehicle or dealing with law enforcement after an accident.

Conclusive Thoughts

In conclusion, same-day auto insurance stands as a valuable resource for those seeking quick and reliable coverage. By understanding the nuances of this insurance option, you can make informed choices that align with your needs and priorities. Whether you encounter unexpected situations or simply prefer the flexibility of immediate coverage, same-day auto insurance offers a solution worth considering.

FAQ Resource

What are the benefits of opting for same-day auto insurance?

Same-day auto insurance provides immediate coverage, making it ideal for situations where you need to drive a vehicle on short notice without prior insurance.

How does pricing typically vary between traditional auto insurance and same-day options?

Same-day auto insurance may be more expensive due to the quick turnaround and immediate coverage it offers compared to traditional insurance plans.

Are there any legal implications or requirements related to same-day auto insurance?

It's essential to ensure that the same-day auto insurance you choose meets the legal requirements in your state to avoid any penalties or issues in case of an accident.