Embark on a journey through the realm of homeowners insurance quotes, where valuable insights and tips await to help you navigate the complex world of insurance with ease.

Delve into the details of what a homeowners insurance quote entails and why it's crucial to secure one for your peace of mind and financial protection.

Understanding Homeowners Insurance Quote

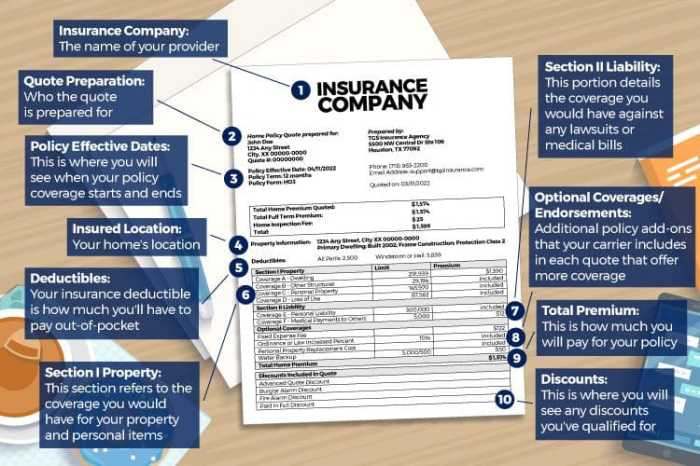

A homeowners insurance quote is an estimate provided by an insurance company that Artikels the cost of coverage for your home. It takes into account various factors such as the value of your home, the location, the coverage options you choose, and other relevant details.

It is important to get a homeowners insurance quote to protect your most valuable asset - your home. In the event of unforeseen circumstances like natural disasters, theft, or accidents, having insurance coverage can provide financial security and peace of mind.

Factors Affecting the Cost of Homeowners Insurance Quote

- The value and age of your home: Older homes or high-value properties may have higher insurance costs due to potential risks.

- Location: Homes in areas prone to natural disasters or high crime rates may have higher insurance premiums.

- Coverage options: The type and amount of coverage you choose will impact the cost of your homeowners insurance quote.

- Claims history: If you have made previous insurance claims, it can affect the cost of your insurance quote.

- Deductible amount: Choosing a higher deductible can lower your premium, but you'll pay more out of pocket in the event of a claim.

Obtaining a Homeowners Insurance Quote

When it comes to obtaining a homeowners insurance quote, there are a few key steps to keep in mind to ensure you receive an accurate estimate for your coverage needs.

Providing Accurate Information

- Be prepared to provide detailed information about your home, including its age, size, construction type, and any recent renovations or upgrades.

- Have documentation on hand regarding safety features such as smoke detectors, alarm systems, and security measures.

- Provide an accurate estimate of the value of your personal belongings and any high-value items that may require additional coverage.

- Disclose any past insurance claims or incidents that could impact your insurance premium.

Methods for Obtaining Insurance Quotes

- Online:Many insurance companies offer online tools that allow you to input your information and receive a quote in minutes.

- Through an Agent:Working with an insurance agent can provide personalized guidance and assistance in navigating the insurance quote process.

- Over the Phone:Some insurance companies offer the option to request a quote over the phone by speaking with a representative.

Coverage Options in a Homeowners Insurance Quote

When obtaining a homeowners insurance quote, it is essential to understand the coverage options included in the policy. These coverage options provide financial protection against various risks that homeowners may face, such as damage to their property or liability for injuries on their premises.It is crucial to carefully review and compare the coverage options mentioned in the quote to ensure that you have adequate protection for your home and belongings.

Here are some common coverage options typically included in a homeowners insurance quote:

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including the walls, roof, foundation, and other attached structures, from covered perils such as fire, windstorm, or vandalism. This coverage is essential as it helps repair or rebuild your home if it is damaged or destroyed.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, clothing, electronics, and appliances, from covered perils. In the event of theft, fire, or other covered incidents, this coverage helps replace or repair your personal items

Liability Coverage

Liability coverage protects you against financial loss if someone is injured on your property and decides to sue you for damages. This coverage can help cover legal fees, medical expenses, and settlement costs if you are found liable for the injury.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, helps pay for temporary living expenses if your home becomes uninhabitable due to a covered loss. This coverage can cover expenses such as hotel bills, food costs, and other necessary living expenses.Understanding these coverage options and their benefits can help you make an informed decision when selecting a homeowners insurance policy.

It is essential to assess your needs and risks to ensure that you have the right coverage in place to protect your home and assets.

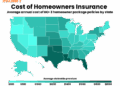

Factors Influencing Homeowners Insurance Quotes

When it comes to generating homeowners insurance quotes, insurance companies take various factors into consideration to assess risk and determine the premium. Understanding these key factors can help homeowners make informed decisions and potentially lower their insurance quotes.

Location

The location of your home plays a significant role in determining your homeowners insurance quote. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher premiums due to increased risk of damage.

Home Value and Construction

The value of your home and the materials used in its construction also impact your insurance quote. Higher home values and expensive construction materials may lead to higher premiums as they would cost more to repair or replace in case of damage.

Claims History

Your claims history can influence your homeowners insurance quote. If you have a history of filing numerous claims, insurance companies may consider you a higher risk policyholder, resulting in higher premiums. On the other hand, a clean claims history may lead to lower quotes.

Home Security Features

Having security features such as alarm systems, deadbolts, and smoke detectors in your home can potentially lower your insurance quote. These features reduce the risk of theft, fire, and other incidents, making your home safer and less likely to file a claim.

Credit Score

Insurance companies may also consider your credit score when determining your homeowners insurance quote. A higher credit score can indicate financial responsibility and prompt payment of premiums, potentially leading to lower quotes.

End of Discussion

As we reach the end of this discussion, remember that knowledge is power when it comes to homeowners insurance quotes. Arm yourself with the information provided to make informed decisions and safeguard your home effectively.

Helpful Answers

What factors can affect the cost of a homeowners insurance quote?

The cost of a homeowners insurance quote can be influenced by factors such as the location of your home, its value, your claims history, and the coverage options you choose.

How can homeowners potentially lower their insurance quotes?

Homeowners can potentially lower their insurance quotes by improving home security measures, maintaining a good credit score, bundling insurance policies, and opting for a higher deductible.

What are the common coverage options included in a homeowners insurance quote?

Common coverage options in a homeowners insurance quote typically include dwelling coverage (for the structure of the home), personal property coverage (for belongings), liability coverage, and additional living expenses coverage.