Diving into the realm of home insurance quotes, this introduction aims to provide a comprehensive and engaging overview of the topic. From the importance of home insurance to the various policy types and factors affecting quotes, this guide will equip readers with valuable insights to navigate the world of home insurance with confidence.

In the following sections, we will delve into the intricacies of home insurance quotes, shedding light on common FAQs and providing relevant information to help homeowners make informed decisions.

Importance of Home Insurance

Home insurance is a crucial aspect for homeowners to protect their most valuable asset. It provides financial security and peace of mind in case of unexpected events.

Protection Against Natural Disasters

Home insurance coverage is essential in situations like floods, earthquakes, hurricanes, or wildfires. These natural disasters can cause severe damage to your home, and having insurance can help cover the costs of repairs or rebuilding.

Financial Security for Liability Claims

In the unfortunate event of someone getting injured on your property, home insurance can provide liability coverage. This protects you from potential lawsuits and medical expenses that may arise from accidents on your premises.

Rebuilding and Repair Costs

If your home suffers damage from fire, vandalism, or theft, home insurance can help cover the costs of repairs or even rebuilding your home. This can prevent a significant financial burden on you and your family.

Types of Home Insurance Policies

When it comes to protecting your home, there are different types of home insurance policies available to cater to your specific needs and budget. Let's explore the various options and compare their coverage.

HO-1: Basic Form Policy

The HO-1 policy is a basic form of coverage that typically protects against specific perils such as fire, theft, vandalism, and certain natural disasters. It offers limited coverage compared to other policies and may not be suitable for all homeowners.

HO-2: Broad Form Policy

The HO-2 policy provides more comprehensive coverage than the HO-1, including protection against a broader range of perils. This type of policy is a popular choice for homeowners looking for increased coverage at an affordable price.

HO-3: Special Form Policy

The HO-3 policy is the most common type of home insurance policy and offers broad coverage for your home and personal belongings. It typically protects against all perils except for those specifically excluded in the policy.

HO-4: Renter’s Insurance

Renter's insurance, also known as an HO-4 policy, is designed for tenants renting a home or apartment. It covers personal belongings, liability protection, and additional living expenses in case the rental property becomes uninhabitable.

HO-5: Comprehensive Form Policy

The HO-5 policy is a premium option that provides extensive coverage for both your home and personal belongings. It offers broader protection than the HO-3 policy, making it ideal for homeowners with high-value assets.

HO-6: Condo Insurance

Condo insurance, or an HO-6 policy, is specifically tailored for condo owners. It typically covers the interior of the condo unit, personal property, liability protection, and additional living expenses.

HO-8: Older Home Policy

The HO-8 policy is designed for older homes that may have unique construction features or may be harder to repair or replace. It provides limited coverage for the dwelling and may be a suitable option for historic homes.

Factors Affecting Home Insurance Quotes

When it comes to determining home insurance quotes, several key factors play a significant role in influencing the cost of premiums. Understanding these factors can help homeowners make informed decisions and potentially reduce their insurance expenses.

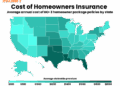

Location

The location of your home is a crucial factor that affects your insurance quotes. Homes in areas prone to natural disasters such as floods, earthquakes, or hurricanes typically have higher insurance premiums due to the increased risk of damage.

Home Value

The value of your home is another important factor that impacts insurance quotes. More expensive homes generally require higher coverage limits, leading to higher premiums. It is essential to accurately assess the value of your home to ensure you have adequate coverage without overpaying.

Deductible

The deductible you choose for your home insurance policy directly affects your premium costs. A higher deductible means lower premiums, but it also means you'll have to pay more out of pocket in the event of a claim. Finding the right balance between deductible and premium cost is key to managing your insurance expenses.

Home Security Features

Homes equipped with security features such as alarm systems, smoke detectors, and deadbolts may qualify for discounts on insurance premiums. Investing in these safety measures not only protects your home but can also help reduce your insurance costs.

Claim History

Your past claim history can also impact your home insurance quotes. If you have a history of frequent claims, insurers may consider you a higher risk and charge higher premiums. Maintaining a claims-free record can help keep your insurance costs down.

Personal Factors

Factors such as your credit score, age, and occupation can also influence your home insurance quotes. Insurers may use these personal details to assess risk and determine premiums. Improving your credit score, maintaining a stable job, and demonstrating responsible behavior can potentially lower your insurance costs.

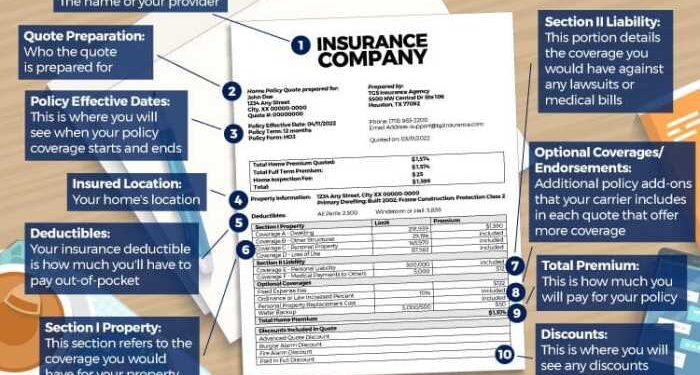

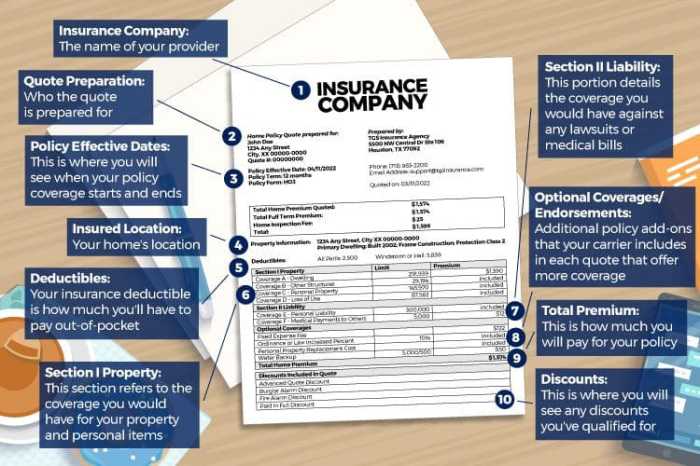

Obtaining a Home Insurance Quote

When it comes to obtaining a home insurance quote, homeowners need to provide specific information to insurance providers. This information is crucial in determining the coverage options and the cost of the insurance policy. It is essential to compare quotes from multiple insurers before making a decision to ensure you get the best coverage at a competitive price.

Information Needed for a Home Insurance Quote

To get an accurate home insurance quote, homeowners will typically need to provide the following information:

- Property details, including the address, type of home, square footage, and year of construction.

- Details about the home's structure, such as the roof type, number of stories, and any additional features like a swimming pool or detached garage.

- Information on the home's safety and security features, such as smoke detectors, burglar alarms, and deadbolts.

- A list of valuable items or high-ticket possessions that may require additional coverage.

- Prior insurance history and any claims made in the past.

- Personal information about the homeowners, including their age, occupation, and credit score.

Importance of Comparing Quotes

It is crucial to compare quotes from multiple insurance providers before choosing a home insurance policy. By comparing quotes, homeowners can:

- Ensure they are getting the best coverage for their needs at a competitive price.

- Identify any gaps in coverage or additional features offered by different insurers.

- Find potential discounts or savings that may vary between insurance companies.

- Understand the level of customer service and claims support provided by different insurers.

- Make an informed decision based on a comprehensive comparison of available options.

Summary

As we conclude our exploration of home insurance quotes, it becomes evident that securing the right coverage is not just a financial decision but also a peace-of-mind investment. By understanding the nuances of different policy types and the factors influencing quotes, homeowners can proactively protect their homes and loved ones.

Stay informed, stay protected.

FAQ Resource

What factors can affect my home insurance quote?

Factors such as location, home value, deductible amount, and the chosen coverage options can significantly impact your home insurance quote. Insurers consider these factors to assess the level of risk associated with insuring your property.

How can I lower my home insurance quote?

To potentially reduce your home insurance quote, consider increasing your home security measures, bundling policies with the same insurer, raising your deductible, and maintaining a good credit score. These actions can help lower your premium costs.

Why is it important to compare quotes from multiple insurers?

Comparing quotes from different insurers allows you to find the most competitive rates and coverage options that suit your needs. By exploring multiple options, you can ensure you are getting the best value for your home insurance policy.