Delving into the realm of home insurance coverage types, this introduction aims to intrigue and inform readers about the different aspects of protecting their homes.

Providing insights into the nuances of coverage types and their practical implications, this article sets the stage for a comprehensive understanding of home insurance.

Overview of Home Insurance Coverage Types

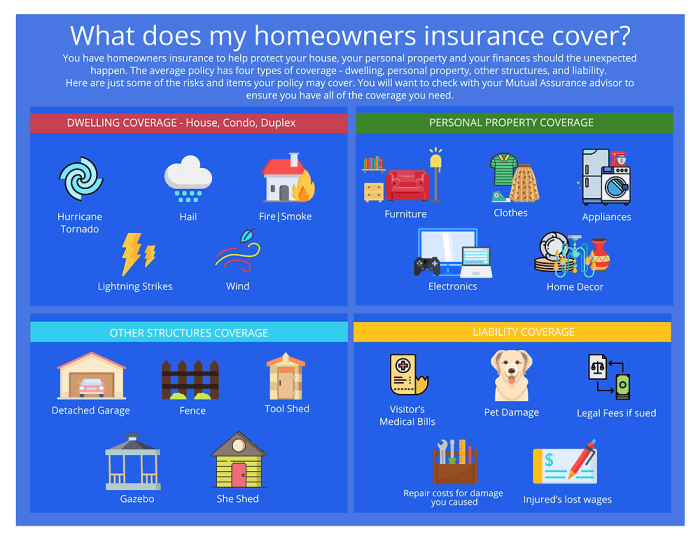

When it comes to home insurance, there are different types of coverage that offer protection for various aspects of your property. It is essential to understand these different coverage types to ensure that you have the right level of protection for your home.Having a comprehensive home insurance policy can provide financial security in case of unexpected events such as natural disasters, theft, or accidents.

Here are some examples of situations where different coverage types are beneficial:

Types of Home Insurance Coverage

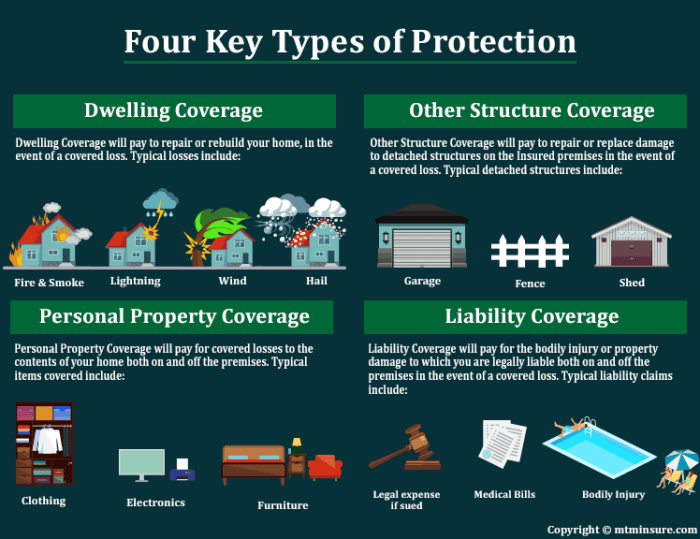

- 1. Dwelling Coverage: This type of coverage protects the structure of your home, including the walls, roof, and foundation, in case of damage from covered perils like fire, windstorm, or vandalism.

- 2. Personal Property Coverage: This coverage helps replace or repair your personal belongings such as furniture, electronics, and clothing if they are damaged or stolen.

- 3. Liability Coverage: Liability coverage protects you in the event someone is injured on your property and decides to sue you for damages. It can help cover legal fees, medical expenses, and other costs.

- 4. Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage can help pay for temporary living expenses such as hotel bills or meals while your home is being repaired.

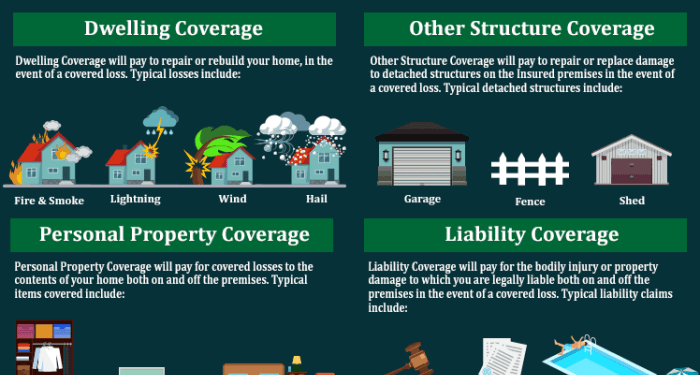

Dwelling Coverage

Dwelling coverage is a fundamental part of a home insurance policy that protects the physical structure of your house. This coverage typically includes the walls, roof, foundation, and other structures attached to the home.

What is Covered

- Damage from fire, lightning, wind, hail, and other covered perils

- Structural damage to the home

- Detached structures like garages or sheds

- Repairs or rebuilding costs in case of damage

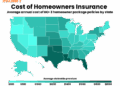

Factors Impacting Coverage

- Location of the home: Areas prone to natural disasters may require higher coverage limits.

- Home value: The cost to rebuild your home will influence the amount of dwelling coverage needed.

- Age of the home: Older homes may have higher maintenance costs and require more coverage.

- Construction materials: The materials used in building your home can impact the cost of repairs or replacement.

Personal Property Coverage

When it comes to home insurance, personal property coverage is a crucial component that protects your belongings inside your home in case of theft, damage, or loss. This coverage extends beyond just the physical structure of your house and provides financial protection for your personal possessions.

Examples of Items Covered

- Furniture

- Electronics

- Clothing

- Jewelry

- Appliances

Determining the appropriate coverage limits for your personal belongings is essential to ensure you have enough coverage in case of a claim. It's recommended to create a home inventory list detailing all your possessions and their value. This will help you accurately estimate the total value of your personal property and set the appropriate coverage limits to adequately protect your belongings.

Liability Coverage

Liability coverage in home insurance policies is designed to protect you in situations where you are found legally responsible for injuries or damages to other people or their property. This coverage helps cover the costs of legal fees, medical bills, and damages awarded in a lawsuit.

Scenarios Where Liability Coverage Comes Into Play

- Accidents on your property: If a guest slips and falls at your home and sustains injuries, liability coverage can help cover their medical expenses.

- Dog bites: If your dog bites someone, resulting in injuries that require medical attention, liability coverage can help cover the costs.

- Property damage: If you accidentally damage your neighbor's property, such as a fence or a vehicle, liability coverage can help cover the repair or replacement costs.

Importance of Having Adequate Liability Coverage

Having adequate liability coverage is crucial to protect your assets and savings in the event of a lawsuit. Without sufficient coverage, you may be personally responsible for paying for legal fees, medical bills, and damages awarded to the injured party.

It provides you with peace of mind knowing that you have financial protection in case of unforeseen accidents or incidents on your property.

Additional Living Expenses Coverage

When your home becomes uninhabitable due to a covered peril, such as a fire or natural disaster, additional living expenses coverage can help pay for temporary living arrangements while your home is being repaired or rebuilt.

What Does Additional Living Expenses Coverage Entail?

Additional living expenses coverage typically includes costs for hotel stays, meals, and other necessary expenses that exceed your normal living expenses.

When Is This Coverage Necessary?

This coverage is essential when you are unable to live in your home due to damages from a covered event. It ensures that you and your family have a place to stay and basic needs met during the restoration process.

Examples of Situations Where This Coverage Is Beneficial:

- If a fire damages your home and you need to stay in a hotel while repairs are being done.

- In the event of a natural disaster that makes your home unsafe to live in, forcing you to seek temporary housing.

- When your home is being renovated, and you need to find alternative accommodation for a period of time.

Outcome Summary

Concluding our discussion on home insurance coverage types, it's evident that a well-rounded policy can safeguard against various unforeseen circumstances. With the right coverage in place, homeowners can enjoy peace of mind knowing their investment is protected.

Detailed FAQs

What does dwelling coverage entail?

Dwelling coverage typically protects the structure of your home, including walls, roof, and foundation, in case of damage from covered perils.

How can one determine appropriate coverage limits for personal belongings?

Calculating the value of your personal items and considering potential risks can help in deciding on suitable coverage limits for personal property.

Why is liability coverage important in home insurance?

Liability coverage can protect homeowners from legal claims and financial obligations if someone is injured on their property or if they damage someone else's property.

When might additional living expenses coverage be necessary?

This coverage can be essential when your home becomes uninhabitable due to a covered event, such as a fire, and you need to temporarily live elsewhere.