Starting off with a focus on cheap homeowners insurance, this introductory paragraph aims to grab the readers' attention and provide a glimpse of what's to come.

Moving on to explore the different aspects of homeowners insurance and how to make it more budget-friendly.

Introduction to Homeowners Insurance

Homeowners insurance is a crucial financial protection that provides coverage for your home and belongings in the event of unforeseen circumstances such as natural disasters, theft, or accidents. It offers peace of mind knowing that you are financially secure in case of any damage or loss.

Types of Coverage in Homeowners Insurance

Standard homeowners insurance typically includes the following types of coverage:

- Dwelling Coverage: This covers the structure of your home in case of damage from covered perils like fire, hail, or windstorms.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, clothing, and electronics.

- Liability Coverage: This provides protection if someone is injured on your property and you are found legally responsible.

- Additional Living Expenses: In case your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary living arrangements.

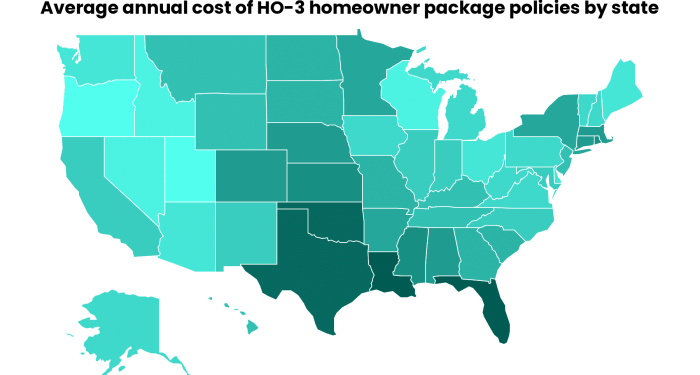

Factors Affecting Homeowners Insurance Premiums

Several factors can influence the cost of your homeowners insurance premiums:

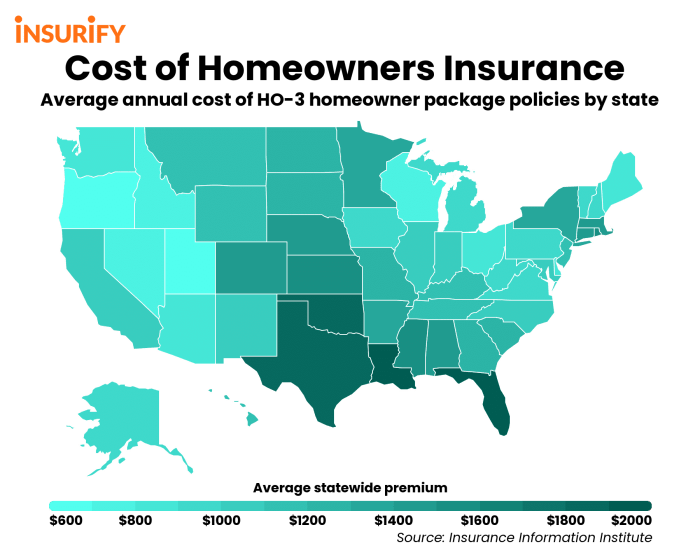

- Location: The area where your home is located, including proximity to fire stations, crime rates, and weather risks, can impact your premiums.

- Home Characteristics: Factors such as the age of your home, construction materials used, and the condition of the roof can affect your insurance costs.

- Claim History: If you have a history of filing insurance claims, it may lead to higher premiums as you are seen as a higher risk to insure.

- Deductible Amount: Choosing a higher deductible can lower your premiums, but you will have to pay more out of pocket in case of a claim.

Factors Influencing Homeowners Insurance Costs

When it comes to determining homeowners insurance costs, several factors come into play. Understanding how these factors can impact your insurance rates is crucial for making informed decisions.

Location of Home

The location of your home plays a significant role in determining your homeowners insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods typically have higher insurance rates. Additionally, the crime rate in your area can also affect your insurance costs.

Age and Condition of Home

The age and condition of your home are important factors that insurance companies consider when calculating premiums. Older homes or homes in poor condition may be more susceptible to damage, leading to higher insurance costs. Regular maintenance and upgrades can help reduce these costs.

Coverage Limits and Deductibles

The coverage limits and deductibles you choose for your homeowners insurance policy can also impact the affordability of your premium. Opting for higher coverage limits or lower deductibles will result in higher premiums, while choosing lower coverage limits or higher deductibles can help lower your costs.

It's essential to find the right balance that meets your needs while staying within your budget.

Strategies to Find Cheap Homeowners Insurance

When it comes to finding affordable homeowners insurance, there are several strategies you can use to lower your premiums and get the coverage you need without breaking the bank

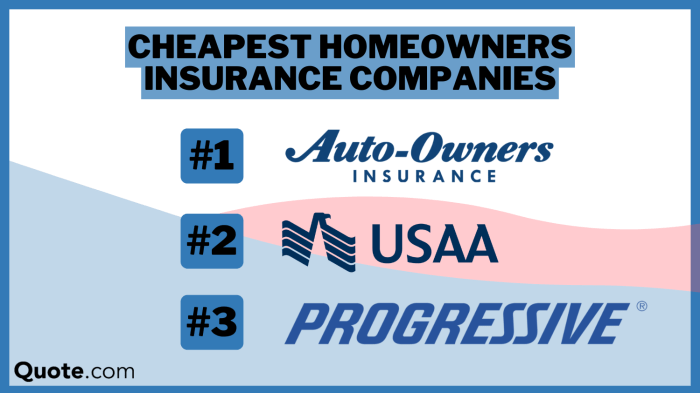

Comparing Quotes from Different Insurance Providers

- Get quotes from multiple insurance companies to compare rates and coverage options.

- Consider working with an independent insurance agent who can help you compare quotes from different providers.

- Look for discounts or special offers that may be available through certain insurance companies.

Bundling Home and Auto Insurance

- Bundle your home and auto insurance policies with the same provider to potentially lower your overall costs.

- Insurance companies often offer discounts for customers who have multiple policies with them.

- Ask your insurance provider about bundling options and any available discounts.

Improving Home Security and Safety

- Install a security system, smoke detectors, and carbon monoxide detectors in your home to reduce the risk of accidents or theft.

- Consider upgrading your home's roof, plumbing, and electrical systems to make your property safer and potentially lower insurance premiums.

- Ask your insurance provider about any specific safety measures you can take to qualify for discounts on your homeowners insurance.

Additional Ways to Lower Homeowners Insurance Costs

When looking to reduce homeowners insurance costs, there are several strategies you can consider beyond just finding cheap premiums. These additional methods can help you save money while still getting the coverage you need.

Raising Deductibles to Decrease Insurance Premiums

One effective way to lower your homeowners insurance costs is by increasing your deductibles. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can often lower your monthly premiums.

However, it's essential to make sure you have enough savings set aside to cover the higher deductible in case you need to make a claim.

Maintaining a Good Credit Score

Your credit score can have a significant impact on your homeowners insurance rates. Insurers often use credit-based insurance scores to determine premiums, with higher scores generally leading to lower rates. By maintaining a good credit score, you can potentially qualify for better rates on your homeowners insurance.

Make sure to regularly check your credit report and work on improving your score if needed.

Exploring Discounts for Specific Homeowners

Certain homeowners may be eligible for discounts on their insurance premiums. For example, seniors or members of specific organizations may qualify for special discounts. It's worth checking with your insurance provider to see if you are eligible for any discounts based on your age, occupation, or affiliations.

Taking advantage of these discounts can help you lower your overall homeowners insurance costs.

Concluding Remarks

Wrapping up our discussion on affordable homeowners insurance, we've covered various strategies to help you save on your policy while still ensuring adequate coverage for your home.

FAQ Resource

How can I compare quotes effectively?

It's important to gather quotes from multiple insurance providers and compare coverage limits and deductibles to find the best value.

Does bundling home and auto insurance really save money?

Yes, bundling your home and auto insurance policies with the same provider often leads to discounts and cost savings.

What discounts are available for homeowners?

Homeowners may be eligible for discounts based on factors like home security systems, good credit scores, or membership in specific organizations.