Exploring the realm of homeowners insurance unveils a world of protection and peace of mind. As individuals navigate the complexities of safeguarding their homes and belongings, the quest for the best homeowners insurance becomes a paramount decision. This guide delves into the intricacies of coverage options, factors to consider, and money-saving tips, providing a comprehensive roadmap for homeowners seeking security and value.

Understanding Homeowners Insurance

Homeowners insurance is a type of insurance policy that provides financial protection against damages to a person's home and personal belongings. It is designed to cover the costs of repairs or replacement in case of damage or loss due to covered perils.

Types of Coverage in Homeowners Insurance

- Dwelling coverage: This covers the physical structure of the home, including walls, roof, and foundation, in case of damage from covered perils such as fire, wind, or theft.

- Personal property coverage: This protects personal belongings inside the home, such as furniture, electronics, and clothing, in case of theft or damage.

- Liability coverage: This provides protection in case someone is injured on the homeowner's property and decides to sue for damages.

- Additional living expenses coverage: This covers the costs of temporary living arrangements if the home becomes uninhabitable due to a covered loss.

How Homeowners Insurance Works

Homeowners insurance works by providing financial protection to the homeowner in case of unexpected events that result in damage or loss. When a covered peril occurs, the homeowner can file a claim with the insurance company. The insurer will then assess the damage, determine the coverage amount, and provide compensation to repair or replace the damaged property or belongings.

It is important for homeowners to review their policy and understand the coverage limits and exclusions to ensure they are adequately protected.

Factors to Consider When Choosing the Best Homeowners Insurance

When selecting a homeowners insurance policy, there are several key factors that individuals should consider to ensure they have the right coverage for their needs. Factors such as the location of the home, insurance rates, coverage options, and personal property value all play a crucial role in determining the best homeowners insurance policy.

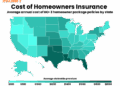

Impact of Home Location on Insurance Rates and Coverage Options

The location of your home can significantly impact your insurance rates and coverage options. Homes located in areas prone to natural disasters such as floods, earthquakes, or wildfires may have higher insurance premiums to account for the increased risk of damage.

Additionally, homes in high-crime areas may also face higher rates due to the risk of theft or vandalism. It's essential to consider the location of your home and any potential risks associated with it when choosing a homeowners insurance policy.

Assessing Personal Property Value for Coverage Limits

When selecting coverage limits for your homeowners insurance policy, it's crucial to assess the value of your personal property accurately. This includes items such as furniture, electronics, clothing, and other belongings that would need to be replaced in the event of a covered loss.

Underestimating the value of your personal property could leave you underinsured and unable to replace all of your belongings in the event of a disaster. Taking inventory and determining the value of your personal property can help you choose the appropriate coverage limits to protect your assets.

Comparing Different Homeowners Insurance Providers

When it comes to protecting your home, choosing the right homeowners insurance provider is crucial

List of Reputable Homeowners Insurance Companies

- State Farm

- Allstate

- USAA

- Liberty Mutual

- Amica Mutual

Comparing Coverage Options, Rates, and Customer Service

When comparing different homeowners insurance providers, it is essential to look at the coverage options, rates, and customer service they offer. Here is a breakdown of these key factors:

- Coverage Options:Some insurance providers offer more comprehensive coverage options, such as protection against natural disasters, while others may have more limited coverage. It is important to assess your specific needs and choose a provider that offers the right coverage for your home.

- Rates:Rates can vary significantly between insurance companies, so it is essential to compare quotes from different providers to find the most competitive price. Keep in mind that the cheapest option may not always provide the best coverage.

- Customer Service:Good customer service is crucial when dealing with insurance claims or inquiries. Reading reviews and seeking recommendations from friends and family can help you gauge the level of customer service provided by different insurance companies.

Importance of Reading Reviews and Seeking Recommendations

Before making a decision, it is important to read reviews and seek recommendations from others who have experience with the insurance providers you are considering. This can give you valuable insights into the quality of service, claims processing, and overall satisfaction levels of each company.

Tips for Saving Money on Homeowners Insurance

When it comes to homeowners insurance, finding ways to save money while still maintaining adequate coverage is crucial. Here are some strategies to help you reduce your homeowners insurance premiums:

Impact of Home Security Systems and Safety Measures

Installing a home security system or taking safety measures can have a significant impact on your insurance rates. Insurance providers often offer discounts to homeowners with security systems in place, as these reduce the risk of theft or damage to the property.

Additionally, making upgrades such as installing smoke detectors, deadbolts, and fire extinguishers can lead to further savings on your insurance premiums.

Bundling Insurance Policies for Cost Savings

Another effective way to save money on homeowners insurance is by bundling your policies. Many insurance companies offer discounts to customers who purchase multiple policies from them, such as combining your homeowners and auto insurance. By bundling your policies, you can enjoy cost savings while simplifying the management of your insurance coverage.

Last Point

In conclusion, the journey to finding the best homeowners insurance is a crucial one, laden with choices that can impact the safety and financial well-being of individuals and families. By understanding the nuances of coverage, evaluating key factors, and leveraging expert insights, homeowners can embark on a path towards optimal protection and savings.

Expert Answers

What does homeowners insurance cover?

Homeowners insurance typically covers the structure of the home, personal belongings, liability protection, and additional living expenses in case of a covered loss.

How does the location of my home affect insurance rates?

The location of your home can impact insurance rates due to factors like the risk of natural disasters, crime rates in the area, and proximity to emergency services.

Is it important to assess personal property value when choosing coverage limits?

Yes, assessing personal property value is crucial when determining coverage limits to ensure that your belongings are adequately protected in case of a loss.

How can I save money on homeowners insurance?

You can save money on homeowners insurance by bundling policies, installing security systems, raising deductibles, maintaining a good credit score, and comparing quotes from different providers.