Delve into the world of auto insurance with a focus on the best companies that offer quality coverage and reliable services. This guide will navigate you through the intricacies of choosing the right auto insurance provider, ensuring you make an informed decision that suits your needs.

Research on Auto Insurance Companies

When looking for auto insurance, it's crucial to choose a reputable provider that offers the coverage you need at a competitive price. To help you make an informed decision, here are the top 5 auto insurance companies in the market and the criteria used to determine the best ones.

Top 5 Auto Insurance Companies

- State Farm

- Geico

- Progressive

- Allstate

- USAA (for military members and their families)

Criteria for Determining the Best Auto Insurance Companies

- Financial stability and reputation

- Coverage options and discounts offered

- Customer service and claims handling

- Pricing and affordability

- Online and mobile app functionality

Importance of Choosing a Reputable Auto Insurance Provider

Choosing a reputable auto insurance provider ensures that you will receive the support you need when you file a claim and that your coverage will be there when you need it most. A reputable provider will have a strong financial standing, good customer service, and a variety of coverage options to meet your needs.

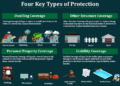

Coverage Options

When it comes to selecting auto insurance coverage, it's essential to compare the options offered by different companies to ensure you have the right protection in place. Understanding the significance of comprehensive coverage versus basic coverage can help you make an informed decision.

Additionally, exploring add-on coverage options provided by the best auto insurance companies can give you extra peace of mind on the road.

Comprehensive Coverage vs. Basic Coverage

- Basic coverage typically includes liability coverage, which helps pay for damages to another person's vehicle or property in an accident where you are at fault.

- Comprehensive coverage goes beyond basic liability and covers damages to your own vehicle from incidents like theft, vandalism, or natural disasters.

- While basic coverage meets legal requirements, comprehensive coverage offers more extensive protection for your vehicle.

Add-On Coverage Options

- Rental Car Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services like towing, battery jump-start, and tire changes if your vehicle breaks down.

- Gap Insurance: Covers the difference between what you owe on a car loan and the car's actual cash value if your vehicle is totaled.

- Accident Forgiveness: Some companies offer this option, which prevents your rates from increasing after your first at-fault accident.

Customer Service and Claims Processing

When it comes to auto insurance, customer service quality and claims processing are crucial factors to consider. The leading auto insurance companies are known for their efficient customer service and streamlined claims processing procedures. Let's take a closer look at how these companies excel in these areas.

Customer Service Quality

Customer service quality is a top priority for the best auto insurance companies. They strive to provide exceptional support to their policyholders through various channels such as phone, email, and online chat. Representatives are knowledgeable, responsive, and courteous, ensuring that customers receive the assistance they need promptly.

- 24/7 Customer Support: Leading auto insurance companies offer round-the-clock customer support to address any queries or concerns that policyholders may have.

- Personalized Assistance: Customer service representatives are trained to provide personalized assistance, guiding customers through the insurance process and helping them choose the right coverage options.

- Quick Response Times: These companies prioritize quick response times, ensuring that customers do not have to wait long to get the help they need.

Claims Processing

Filing a claim with the best auto insurance companies is a straightforward and efficient process. Policyholders can easily submit a claim online or through the company's mobile app, and claims are processed promptly to ensure a speedy resolution.

- Online Claim Submission: Policyholders can submit their claims online, providing all the necessary details and documentation to support their claim.

- Fast Processing: The best auto insurance companies are known for their fast claims processing, with most claims being settled within a few days.

- Dedicated Claims Representatives: These companies assign dedicated claims representatives to handle each claim, providing personalized support and guidance throughout the process.

"The claims process was seamless and efficient. I was kept informed at every step, and my claim was resolved quickly without any hassle."

Satisfied Customer

Pricing and Discounts

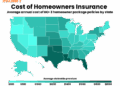

When it comes to auto insurance, pricing is a significant factor that can greatly impact your decision. Understanding the pricing policies and available discounts offered by the best auto insurance companies can help you save money while still maintaining quality coverage.

Pricing Policies

Auto insurance companies determine their pricing based on various factors such as your age, driving record, location, and the type of vehicle you drive. It's essential to compare quotes from different insurers to find the best rates that suit your budget.

Common Discounts

- Multi-policy discount: Many insurers offer discounts if you bundle your auto insurance with other policies such as home or renters insurance.

- Good driver discount: If you have a clean driving record with no accidents or traffic violations, you may be eligible for a good driver discount.

- Low mileage discount: Some companies offer discounts for drivers who don't drive frequently, as they are considered less risky.

- Safe driver discount: Completing a defensive driving course or installing safety features in your vehicle can qualify you for a safe driver discount.

Strategies for Best Rates

To obtain the best rates while maintaining quality coverage, consider increasing your deductible, improving your credit score, and taking advantage of all available discounts. Additionally, maintaining a clean driving record and avoiding filing small claims can help keep your premiums low.

Final Thoughts

In conclusion, selecting the best auto insurance company is crucial for safeguarding your vehicle and ensuring peace of mind on the road. With a plethora of options available, this guide aims to simplify the process and empower you to make a wise choice that aligns with your preferences.

Popular Questions

What criteria are used to determine the best auto insurance companies?

The criteria typically include factors such as financial stability, customer satisfaction ratings, coverage options, pricing, and the ease of claims processing.

What are some common discounts offered by top auto insurance companies?

Common discounts include multi-policy discounts, safe driver discounts, good student discounts, and discounts for safety features on the vehicle.

How can I obtain the best rates while maintaining quality coverage?

To get the best rates, consider bundling policies, maintaining a good driving record, opting for a higher deductible, and taking advantage of available discounts.