Diving into the world of auto insurance quotes, this introduction aims to provide readers with a comprehensive understanding of the topic. From the various types of coverage to the factors affecting insurance quotes, this overview sets the stage for an informative and engaging discussion.

Moving forward, we will delve into the intricacies of obtaining auto insurance quotes, understanding deductibles and premiums, and everything in between to equip you with the knowledge needed to make informed decisions.

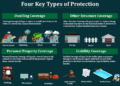

Types of Auto Insurance Coverage

When it comes to auto insurance, there are various types of coverage options available to protect you and your vehicle in different situations. Understanding the differences between each type of coverage can help you make informed decisions when selecting the right policy for your needs.

Liability Coverage

Liability coverage is the most basic type of auto insurance and is required by law in most states. It helps cover costs associated with injuries or property damage you cause to others in an accident. For example, if you rear-end another vehicle and it's determined to be your fault, liability coverage can help pay for the other driver's medical bills and repairs to their car.

Collision Coverage

Collision coverage helps pay for repairs to your own vehicle if you're involved in an accident with another vehicle or object, regardless of who is at fault. For instance, if you accidentally hit a tree or another car hits you, collision coverage can help cover the cost of repairing or replacing your damaged vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision related incidents, such as theft, vandalism, fire, or natural disasters. This type of coverage is important for safeguarding your car against damage that is out of your control. For example, if your car is stolen or damaged in a hailstorm, comprehensive coverage can help cover the cost of repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage can help protect you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage to pay for your medical expenses or vehicle repairs. This type of coverage ensures that you're not left with hefty bills if you're hit by an uninsured driver.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage helps pay for medical expenses and lost wages for you and your passengers after an accident, regardless of who is at fault. PIP coverage is especially beneficial if you don't have health insurance or have high deductibles, as it can help cover immediate medical costs without having to wait for insurance claims to be settled.

Importance of Comprehensive Coverage vs. Liability-Only Coverage

While liability-only coverage is the minimum required by law, comprehensive coverage offers a higher level of protection for your vehicle. Opting for comprehensive coverage can provide peace of mind knowing that your car is protected against a wider range of risks, including theft and natural disasters.

It's essential to weigh the potential costs of repairs or replacements against the premiums for comprehensive coverage to determine the best option for your needs.

Factors Affecting Auto Insurance Quotes

When it comes to calculating auto insurance quotes, insurance companies take into account various factors to determine the level of risk associated with insuring a particular driver and vehicle. These factors can significantly impact the insurance premiums that individuals pay.

Driving Record and Age

- A driver's history on the road plays a crucial role in determining insurance costs. Those with a clean driving record are considered lower risk and may qualify for lower premiums.

- On the other hand, drivers with a history of accidents, traffic violations, or DUIs are seen as higher risk and can expect to pay higher insurance rates.

- Age is another important factor, as younger, inexperienced drivers are statistically more likely to be involved in accidents. As a result, insurance premiums tend to be higher for younger drivers compared to older, more experienced ones.

Vehicle’s Make, Model, and Year

- The make, model, and year of a vehicle also influence insurance costs. Vehicles that are more expensive to repair or replace, such as luxury cars, tend to have higher insurance premiums.

- Newer vehicles with advanced safety features may qualify for discounts, as they are considered safer and less likely to be involved in accidents.

- Older vehicles, on the other hand, may have lower insurance premiums due to their lower market value and repair costs.

Obtaining Auto Insurance Quotes

When it comes to obtaining auto insurance quotes, there are a few key steps to keep in mind. Whether you're looking to renew your current policy or explore options from different providers, the process can be straightforward if you approach it strategically.

Comparing Quotes from Different Providers

One of the first steps in obtaining auto insurance quotes is to gather information from various providers. You can do this by reaching out to insurance companies directly, using online comparison tools, or working with an independent insurance agent. Make sure to provide the same details and coverage preferences to each provider to ensure accurate comparisons.

- Request quotes from at least three different insurance companies to have a good range of options to compare.

- Consider factors such as coverage limits, deductibles, and additional benefits when comparing quotes.

- Look for discounts that you may qualify for, such as safe driver discounts or bundling discounts for insuring multiple vehicles or policies with the same provider.

- Take note of any exclusions or limitations in the coverage offered by each provider to make an informed decision.

Importance of Providing Accurate Information

When requesting auto insurance quotes, it's crucial to provide accurate information about your driving history, vehicle details, and coverage needs. Failing to do so can result in inaccurate quotes and potential issues when filing a claim in the future.

- Ensure that you have your driver's license, vehicle registration, and any relevant documentation on hand when requesting quotes.

- Be honest about your driving record, including any past accidents or traffic violations, as this information can impact the premium you are quoted.

- Provide accurate details about your vehicle, such as the make, model, year, and safety features, to receive an appropriate quote.

- Update your insurance provider if there are any changes to your driving habits or circumstances that could affect your coverage needs.

Understanding Deductibles and Premiums

When it comes to auto insurance, understanding deductibles and premiums is crucial to making informed decisions about your coverage. Deductibles and premiums are key components that directly impact the cost of your insurance policy.

Deductibles and Premiums Defined

- Deductibles:A deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in to cover a claim. For example, if you have a $500 deductible and you file a claim for $2,000 in damages, you would pay $500, and your insurance company would cover the remaining $1,500.

- Premiums:Premiums are the amount you pay to your insurance company for your coverage. This is typically paid on a monthly or annual basis. Your premium is determined based on various factors, including your driving record, age, location, and the type of coverage you choose.

Impact of Choosing a Higher Deductible

When you opt for a higher deductible, you are agreeing to pay more out of pocket in the event of a claim. While this may seem like a financial risk, choosing a higher deductible can actually lead to lower premiums.

Insurance companies view higher deductibles as a sign that you are willing to take on more of the financial burden in case of an accident, which can result in lower premium costs for you.

Illustrative Example

Let's say you have a choice between a $500 deductible and a $1,000 deductible. If you choose the $1,000 deductible, your insurance company may lower your premium by 15-30%. While you would have to pay more out of pocket in the event of a claim, the savings on your premium over time could outweigh the higher deductible amount.

Final Thoughts

In conclusion, auto insurance quotes are a crucial aspect of protecting your vehicle and finances. By grasping the nuances of coverage options, factors affecting quotes, and the importance of accurate information, you are better positioned to secure the right policy for your needs.

Stay informed, stay protected.

Question & Answer Hub

What factors can impact auto insurance quotes?

Factors such as driving record, age, vehicle make, model, and year can significantly influence the cost of auto insurance quotes.

How can I find the best auto insurance coverage at an affordable rate?

Comparing quotes from different providers and ensuring you provide accurate information when requesting quotes can help you find the best coverage at a reasonable price.

What is the role of deductibles in auto insurance?

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower premiums, while a lower deductible typically leads to higher premiums.