Exploring the realm of affordable health insurance plans opens up a world of possibilities for individuals seeking cost-effective coverage. From understanding different plan types to discovering key factors influencing affordability, this guide delves into the intricacies of securing quality healthcare without breaking the bank.

As we unravel the layers of affordable health insurance plans, we uncover valuable insights that can empower you to make informed decisions about your healthcare needs.

Types of Affordable Health Insurance Plans

When it comes to affordable health insurance plans, there are several options available that cater to different needs and budgets. Let's explore some of the types of health insurance plans that are considered affordable.

HMOs (Health Maintenance Organizations)

Health Maintenance Organizations (HMOs) are known for their cost-effective approach to healthcare. These plans typically require you to choose a primary care physician (PCP) who will coordinate all of your healthcare needs. HMOs usually have lower monthly premiums and out-of-pocket costs compared to other plans, making them a popular choice for those looking for affordable coverage.

PPOs (Preferred Provider Organizations)

Preferred Provider Organizations (PPOs) offer a bit more flexibility compared to HMOs. With a PPO plan, you have the option to see any healthcare provider, but you will pay less if you choose a provider within the PPO network. While PPOs generally have higher premiums than HMOs, they still provide affordable coverage for those who want more choice in their healthcare providers.

High-Deductible Health Plans

High-Deductible Health Plans (HDHPs) are another affordable option for individuals looking to save on monthly premiums. These plans come with higher deductibles, meaning you'll have to pay more out-of-pocket before your insurance kicks in. However, HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to save money tax-free for medical expenses.

This can make HDHPs a cost-effective choice for those who are generally healthy and don't anticipate needing frequent medical care.

Government-Subsidized Health Insurance Options

For low-income individuals, there are government-subsidized health insurance options available to help make healthcare more affordable. Programs like Medicaid and the Children's Health Insurance Program (CHIP) provide coverage for those who meet certain income requirements. These programs offer comprehensive healthcare benefits at little to no cost, making them essential resources for those in need of affordable insurance coverage.

Factors Influencing Affordable Health Insurance

Age, location, income, family size, pre-existing conditions, and the role of insurance marketplaces all play a significant role in determining the affordability of health insurance plans.

Age, Location, Income, and Family Size

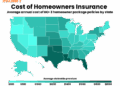

Factors such as age, location, income, and family size can greatly impact the affordability of health insurance plans. Older individuals may face higher premiums compared to younger individuals due to increased health risks associated with age. Additionally, the location of an individual can influence the cost of health insurance, as healthcare costs vary by region.

Income level and family size also play a crucial role, with lower-income households often qualifying for subsidies or Medicaid to make insurance more affordable.

Pre-existing Conditions

Pre-existing conditions can impact the cost and availability of affordable health insurance. Individuals with pre-existing conditions may face higher premiums or be denied coverage altogether by some insurance providers. The Affordable Care Act prohibits insurers from denying coverage or charging higher rates based on pre-existing conditions, ensuring that individuals with health issues can still access affordable insurance.

Role of Insurance Marketplaces and Exchanges

Insurance marketplaces and exchanges play a vital role in providing access to affordable health insurance plans. These platforms allow individuals to compare different plans, prices, and coverage options to find the most suitable and cost-effective insurance plan. They also facilitate the process of applying for subsidies or Medicaid, making healthcare more accessible to those who need it most.

Tips for Finding Affordable Health Insurance

Finding affordable health insurance can be a daunting task, but with the right strategies and knowledge, you can make an informed decision that fits your budget and needs.

Comparing Different Health Insurance Plans

- Research and compare different health insurance plans offered by various providers.

- Consider the coverage options, premiums, deductibles, and out-of-pocket costs of each plan.

- Look for plans that offer the services you need at a price you can afford.

Understanding Terms, Coverage Limits, and Out-of-Pocket Costs

- Make sure to read and understand the terms and conditions of each health insurance plan.

- Pay attention to coverage limits, exclusions, and any restrictions that may apply.

- Calculate potential out-of-pocket costs, including co-payments, deductibles, and coinsurance.

Utilizing Subsidies and Tax Credits

- Check if you qualify for government subsidies or tax credits to help lower the cost of health insurance.

- Explore options for financial assistance based on your income and household size.

- Consult with a tax professional or insurance agent to maximize your savings and affordability.

Benefits of Affordable Health Insurance Plans

Affordable health insurance plans offer a wide range of benefits that can positively impact individuals and families in various ways.

Preventative Care Coverage

- Regular check-ups and screenings are often covered, allowing for early detection of health issues.

- Preventative care can help manage chronic conditions and prevent more serious health problems in the future.

- By addressing health concerns early on, overall healthcare costs can be reduced significantly.

Peace of Mind and Financial Security

- Having affordable health insurance coverage can provide peace of mind knowing that medical expenses will be partially or fully covered.

- In the event of unexpected illnesses or accidents, individuals can avoid financial strain by having insurance to help with costly medical bills.

- Health insurance can provide a safety net, ensuring that individuals and families can access necessary medical care without worrying about the financial burden.

Closing Notes

In conclusion, affordable health insurance plans not only offer financial protection but also provide peace of mind knowing that you have access to essential healthcare services. By leveraging the tips and information shared in this guide, you can pave the way towards a healthier and more secure future.

Questions Often Asked

How do I determine which health insurance plan is the most affordable for me?

Comparing premiums, deductibles, and out-of-pocket costs can help you identify the most cost-effective option based on your healthcare needs.

Can I still get affordable health insurance if I have a pre-existing condition?

Under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions, making it possible to find affordable options.

Are there ways to lower the cost of health insurance through subsidies and tax credits?

Yes, subsidies and tax credits are available to eligible individuals to reduce the cost of health insurance premiums, making coverage more affordable.