Health insurance for freelancers sets the stage for this informative guide, shedding light on a crucial aspect of self-employment that often goes overlooked. As freelancers juggle multiple responsibilities, ensuring access to quality healthcare becomes paramount.

Exploring the nuances of different health insurance options and considerations can empower freelancers to make informed decisions about their well-being and financial security.

Overview of Health Insurance for Freelancers

Health insurance for freelancers refers to the coverage that self-employed individuals obtain to help pay for medical expenses. Unlike traditional employees who may receive health insurance benefits through their employers, freelancers must secure their own insurance plans.

Importance of Health Insurance for Freelancers

Health insurance is crucial for freelancers as it provides financial protection against unexpected medical costs. Without insurance, freelancers may face significant financial burden in case of illness or injury, potentially leading to debt or bankruptcy.

Challenges Freelancers Face in Obtaining Health Insurance

- Lack of employer-sponsored coverage options

- High cost of individual health insurance plans

- Limited access to group insurance rates

- Complexity of navigating the healthcare marketplace

Statistics on Freelancers Without Health Insurance

According to a recent survey, approximately 15% of freelancers in the US do not have health insurance coverage.

Types of Health Insurance Options for Freelancers

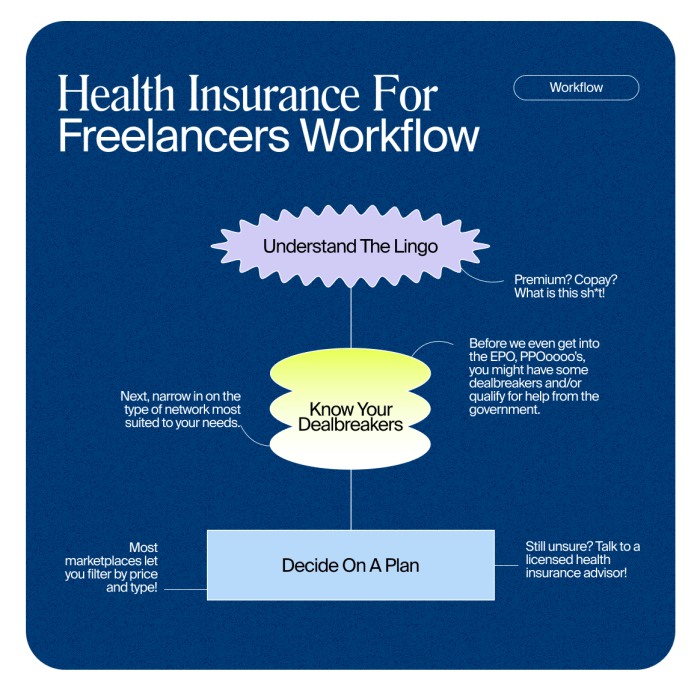

As a freelancer, navigating the world of health insurance can be challenging. Understanding the various options available to you is crucial in ensuring you have the coverage you need. Here, we will explore different types of health insurance options tailored for freelancers.

Individual Health Insurance Plans vs. Group Health Insurance Plans

When it comes to health insurance, freelancers often have the choice between individual health insurance plans and group health insurance plans. Individual plans are purchased directly from an insurance provider, offering personalized coverage based on your needs. On the other hand, group plans are typically obtained through organizations or associations, providing coverage to a group of people.

While individual plans may offer more flexibility and customization, group plans can sometimes be more cost-effective due to group discounts.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are another option for freelancers looking to save for medical expenses. HSAs allow you to set aside pre-tax dollars for qualified medical expenses, offering a tax-advantaged way to save for healthcare costs. Freelancers can benefit from the flexibility and potential savings that HSAs provide, making it a valuable option to consider.

Short-Term Health Insurance Plans

Short-term health insurance plans offer temporary coverage for freelancers who may experience gaps in their health insurance. These plans are typically more affordable than traditional plans and provide coverage for a limited duration, making them ideal for freelancers in transition periods or awaiting long-term coverage.

While short-term plans may not offer comprehensive coverage, they can serve as a temporary solution to bridge any coverage gaps.

Health Sharing Ministries

Health sharing ministries present an alternative to traditional health insurance for freelancers. These non-profit organizations allow members to share medical expenses among the group, providing a community-based approach to healthcare coverage. While health sharing ministries may not be regulated like traditional insurance plans, they can offer cost-effective options for freelancers seeking a unique way to manage their healthcare expenses.

Factors to Consider When Choosing Health Insurance as a Freelancer

Choosing the right health insurance plan as a freelancer is crucial for your financial and physical well-being. Here are some key factors you should consider:

Coverage for Pre-existing Conditions

It is essential to ensure that the health insurance plan you choose covers pre-existing conditions. This is particularly important for freelancers who may have existing health issues that require ongoing treatment.

Premiums, Deductibles, and Copayments

When selecting a health insurance plan, pay close attention to the premiums, deductibles, and copayments. Premiums are the monthly payments you make to keep your insurance active, while deductibles are the amount you must pay out of pocket before your insurance kicks in.

Copayments are fixed amounts you pay for medical services after you've reached your deductible. Understanding these costs is crucial for budgeting your healthcare expenses effectively.

Finding Affordable Options

To find affordable health insurance options as a freelancer, consider shopping around and comparing different plans. Look for plans with a good balance of coverage and cost. Additionally, you may explore options such as health savings accounts (HSAs) or joining professional organizations that offer group health insurance plans at discounted rates.

Resources and Tools for Freelancers to Navigate Health Insurance

As a freelancer, navigating the world of health insurance can be overwhelming. Fortunately, there are resources and tools available to help you make informed decisions about your healthcare coverage. From online platforms to subsidy calculators, here are some ways freelancers can navigate health insurance effectively.

Online Platforms for Comparing Health Insurance Plans

- HealthCare.gov: This official website allows freelancers to compare different health insurance plans based on their needs and budget.

- eHealthInsurance: Freelancers can use this platform to explore a variety of health insurance options and easily compare prices and coverage benefits.

- Policygenius: This online platform offers a user-friendly interface for freelancers to compare health insurance plans and find the best fit for their individual circumstances.

Using Subsidy Calculators for Financial Assistance

- Subsidy calculators: These tools can help freelancers determine if they qualify for financial assistance with health insurance premiums based on their income level and household size.

- Health insurance marketplace: Freelancers can also explore options through the health insurance marketplace to see if they qualify for subsidies or tax credits to reduce their healthcare costs.

Role of Insurance Brokers or Agents

- Insurance brokers: These professionals can provide personalized guidance to freelancers in choosing the right health insurance plan that meets their specific needs and budget.

- Agents: Health insurance agents can help freelancers navigate the complex insurance landscape, explain policy details, and assist with enrollment processes.

Staying Informed About Policy Changes

- Newsletters and updates: Subscribing to newsletters or updates from health insurance providers can help freelancers stay informed about changes in policies, regulations, and coverage options.

- Professional associations: Joining freelancer associations or industry groups can also provide valuable resources and information on healthcare trends and updates relevant to freelancers.

Ultimate Conclusion

In conclusion, understanding the intricacies of health insurance as a freelancer is essential for long-term success and peace of mind. By leveraging the insights shared in this guide, freelancers can navigate the complex landscape of healthcare with confidence and clarity.

Common Queries

What are the key factors to consider when choosing health insurance as a freelancer?

Freelancers should prioritize factors such as coverage for pre-existing conditions, premiums, deductibles, and copayments, along with network coverage and prescription drug benefits.

Are short-term health insurance plans a viable option for freelancers?

Short-term health insurance plans can be a temporary solution for freelancers in between coverage, but they typically offer limited benefits and may not cover pre-existing conditions.

How can freelancers find affordable health insurance options?

Freelancers can explore Health Savings Accounts (HSAs), compare different plans online, consider health sharing ministries, and consult insurance brokers for cost-effective options.