Delve into the realm of cheap health insurance where cost-saving solutions meet quality coverage. Uncover the secrets to navigating the world of affordable healthcare options, ensuring financial security and peace of mind for you and your loved ones.

Explore the various aspects of cheap health insurance and gain valuable insights into making informed decisions regarding your healthcare needs.

What is cheap health insurance?

Affordable health insurance refers to coverage that is available at a low cost to individuals and families, making it more accessible and manageable for budget-conscious individuals. It allows people to obtain necessary medical care without the burden of high premiums or out-of-pocket expenses.

Examples of low-cost health insurance options

- Medicaid: A government program that provides free or low-cost health coverage to eligible low-income individuals and families.

- Children's Health Insurance Program (CHIP): Offers low-cost health coverage for children in families that earn too much to qualify for Medicaid but cannot afford private insurance.

- Health Insurance Marketplace Plans: These plans offer a range of coverage options at different price points, with subsidies available for those who qualify based on income.

- Catastrophic Health Insurance: Provides coverage for major medical expenses after a high deductible is met, making it a more affordable option for those who are generally healthy and only need coverage for emergencies.

Importance of having access to affordable healthcare coverage

Access to affordable healthcare coverage is crucial for ensuring that individuals and families can receive timely medical care, preventive services, and treatment without facing financial hardship. It helps promote overall well-being and reduces the risk of individuals forgoing necessary healthcare due to cost concerns.

Affordable health insurance also plays a key role in protecting individuals from high medical bills and debt in the event of unexpected illness or injury.

Types of cheap health insurance plans

When looking for affordable health insurance options, it's important to understand the different types of plans available to choose the one that best fits your needs and budget.

Health Maintenance Organization (HMO)

An HMO plan typically offers lower premiums and out-of-pocket costs compared to other plans. However, it requires you to choose a primary care physician (PCP) and get referrals to see specialists. While it provides comprehensive coverage for preventive care and basic healthcare services, it may limit your choice of healthcare providers.

Preferred Provider Organization (PPO)

A PPO plan allows you to see any healthcare provider without a referral, offering more flexibility in choosing doctors and hospitals. While it generally has higher premiums and out-of-pocket costs than HMOs, it provides partial coverage for out-of-network services. This type of plan is suitable for individuals who want more control over their healthcare decisions.

Catastrophic Health Insurance

Catastrophic health insurance is designed for young, healthy individuals who want a safety net in case of a major medical emergency. It has low monthly premiums but high deductibles, making it a cost-effective option for those who rarely need medical care but want coverage for severe accidents or illnesses.Each type of affordable health insurance plan has its own coverage and limitations, so it's essential to consider your healthcare needs and budget when choosing the best plan for you.

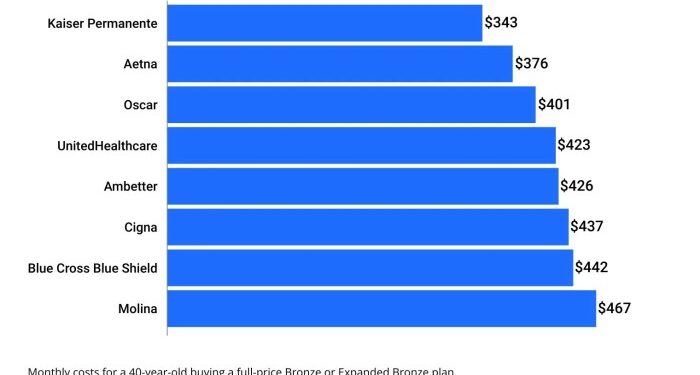

Factors influencing the cost of health insurance

When it comes to determining the cost of health insurance, several key factors play a significant role. Factors such as age, location, lifestyle, and pre-existing conditions can greatly impact the affordability of health insurance for individuals and families. Understanding these factors can help individuals make informed decisions when selecting a health insurance plan.

Age

Age is a crucial factor in determining health insurance costs. Typically, younger individuals tend to pay lower premiums compared to older individuals. This is because younger individuals are generally healthier and are less likely to require extensive medical care.

Location

The location where you reside can also influence the cost of health insurance. Urban areas with higher cost of living may have more expensive health insurance premiums compared to rural areas. Additionally, the availability of healthcare providers in a specific region can impact insurance costs.

Lifestyle

Lifestyle choices such as smoking, excessive drinking, or engaging in high-risk activities can lead to higher health insurance premiums. Insurance companies may charge higher rates to individuals with unhealthy lifestyles due to the increased likelihood of needing medical treatment.

Pre-existing conditions

Individuals with pre-existing medical conditions may face higher health insurance costs. Insurance companies consider pre-existing conditions as a higher risk, which can result in elevated premiums. However, under the Affordable Care Act, insurers are not allowed to deny coverage or charge higher rates based on pre-existing conditions.

Tips to lower health insurance costs

- Compare different health insurance plans to find the most cost-effective option.

- Opt for a higher deductible plan to lower monthly premiums.

- Take advantage of wellness programs offered by insurance companies to maintain a healthy lifestyle.

- Consider a Health Savings Account (HSA) to save money for medical expenses tax-free.

- Stay informed about changes in healthcare laws and regulations to make informed decisions about your coverage.

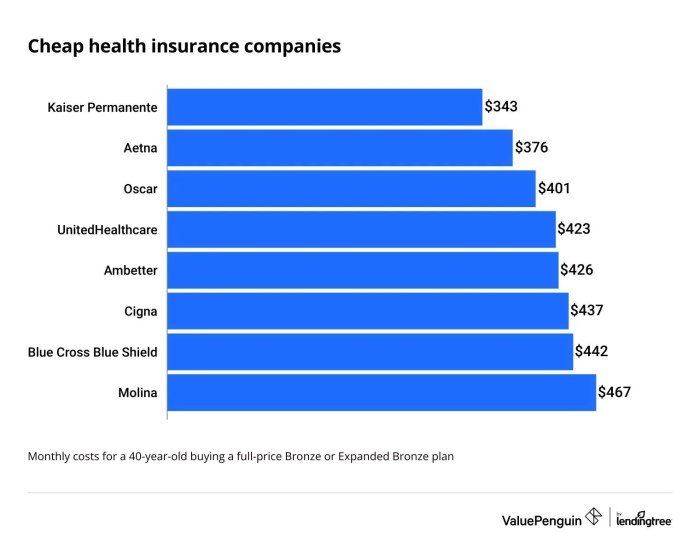

How to find cheap health insurance

Finding affordable health insurance can be a daunting task, but there are strategies you can use to make the process easier and more cost-effective. Government programs such as Medicaid and CHIP offer low-cost or free health coverage for eligible individuals.

Health insurance marketplaces and brokers also play a crucial role in helping individuals find cheap health insurance plans that meet their needs and budget.

Government Programs for Low-Cost or Free Health Coverage

- Medicaid: A state and federally funded program that provides free or low-cost health coverage to eligible low-income individuals and families.

- Children's Health Insurance Program (CHIP): Offers low-cost health coverage for children in families that do not qualify for Medicaid but cannot afford private insurance.

Health Insurance Marketplaces and Brokers

- Health Insurance Marketplaces: These online platforms allow individuals to compare and purchase health insurance plans from different providers. They can help you find affordable options based on your needs and budget.

- Insurance Brokers: These professionals can help guide you through the process of finding and purchasing health insurance. They have knowledge of the market and can help you find the best plan at the lowest cost.

Benefits of having cheap health insurance

Affordable health insurance coverage offers numerous advantages to individuals and families, providing financial security and access to essential healthcare services when needed. Let's explore how having cheap health insurance can benefit you:

Financial Security

- Cheap health insurance helps in reducing out-of-pocket expenses for medical treatments, prescription drugs, and preventive care, ensuring that individuals do not face overwhelming medical bills.

- It provides a safety net against unexpected health emergencies or chronic conditions, allowing individuals to seek necessary medical attention without worrying about the high costs.

Access to Healthcare Services

- Having affordable health insurance enables individuals to access a network of healthcare providers, specialists, hospitals, and clinics for regular check-ups, screenings, and treatments.

- It encourages preventive care and early intervention, promoting overall health and well-being by addressing health issues before they escalate into more serious conditions.

Real-Life Examples

"Sarah, a single mother with two children, was able to afford regular doctor visits and vaccinations for her kids through a low-cost health insurance plan. This ensured that her children stayed healthy and received timely medical care."

"John, a freelance graphic designer, benefited from affordable health insurance when he was diagnosed with a chronic condition. The insurance coverage helped him manage his treatment costs and maintain his quality of life without financial strain."

Last Word

As we reach the end of our journey through the realm of cheap health insurance, remember that accessible healthcare is not just a privilege but a necessity. Let the knowledge gained here empower you to secure the best and most affordable health insurance plan for a healthier future ahead.

Essential Questionnaire

What is cheap health insurance?

Cheap health insurance refers to affordable healthcare coverage that provides essential benefits at a lower cost, making it accessible to a wider range of individuals.

How to find cheap health insurance?

One can find cheap health insurance by exploring different insurance providers, utilizing government programs like Medicaid, and seeking assistance from health insurance marketplaces and brokers.

What factors influence the cost of health insurance?

The cost of health insurance is influenced by factors such as age, location, lifestyle choices, and pre-existing conditions, which can impact the premiums and coverage options available.

What are the benefits of having cheap health insurance?

Having cheap health insurance offers financial security, access to necessary healthcare services, and peace of mind knowing that medical expenses are covered without breaking the bank.