Delving into the world of car insurance estimates, this comprehensive guide aims to shed light on the intricacies of determining the cost of insuring your vehicle. From understanding the basics to practical tips on lowering estimates, this article covers it all.

Understanding Car Insurance Estimate

A car insurance estimate is an approximation of the cost you can expect to pay for your car insurance coverage. It is calculated based on various factors related to you as a driver, your vehicle, and your driving history.

Car insurance estimates are necessary because they help you understand how much you might need to budget for your car insurance premiums. By getting an estimate, you can compare different insurance providers and choose the one that offers you the best coverage at a price that fits your budget.

Factors Influencing Car Insurance Estimates

- Your driving record: A clean driving record with no accidents or traffic violations typically results in lower insurance premiums.

- The type of coverage you choose: Comprehensive coverage will be more expensive than basic liability coverage.

- The make and model of your car: More expensive or high-performance vehicles may cost more to insure.

- Your age and experience: Younger, less experienced drivers often pay higher premiums due to a higher risk of accidents.

- Your location: Urban areas with higher rates of accidents or theft may result in higher insurance premiums.

- Your deductible amount: A higher deductible usually means lower premiums, but you'll pay more out of pocket in case of a claim.

Obtaining a Car Insurance Estimate

When it comes to obtaining a car insurance estimate, there are several key steps involved in the process. Understanding how to get an accurate estimate is crucial in ensuring you have the right coverage for your needs.

The Typical Process for Getting a Car Insurance Estimate

- Research Different Insurance Companies: Start by researching and comparing different insurance companies to find the best coverage options for your budget.

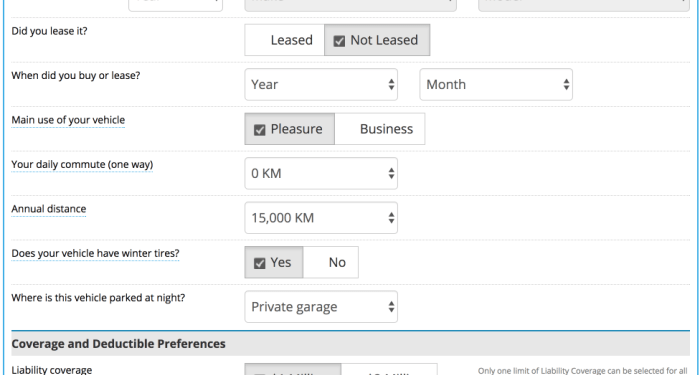

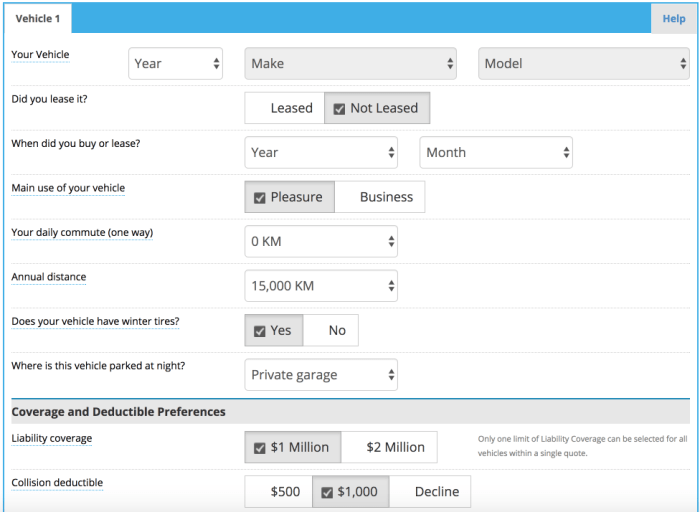

- Provide Necessary Information: You will need to provide information about your vehicle, driving history, and personal details to get an accurate estimate.

- Use Online Tools: Many insurance companies offer online tools or calculators that can provide you with an instant estimate based on the information you provide.

- Get Quotes from Agents: Another way to obtain a car insurance estimate is by contacting insurance agents directly to get personalized quotes based on your specific needs.

- Review and Compare Quotes: Once you have gathered several estimates, take the time to review and compare them to find the best coverage at the most competitive price.

Information Needed to Obtain an Accurate Car Insurance Estimate

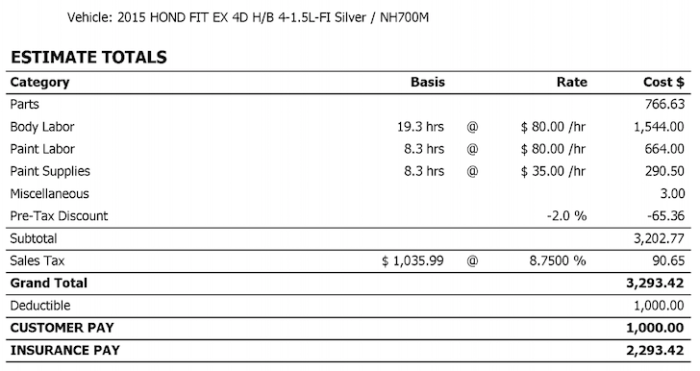

- Vehicle Details: Make and model of the car, year of manufacture, VIN number, and mileage.

- Driving History: Details of any previous accidents, tickets, or claims.

- Personal Information: Age, gender, marital status, and credit score may also be required.

- Coverage Needs: The type of coverage you are looking for, such as liability, comprehensive, collision, or personal injury protection.

Comparison of Different Methods of Obtaining Car Insurance Estimates

- Online Tools: Quick and convenient way to get estimates, but may not always be the most accurate.

- Insurance Agents: Provides personalized service and tailored quotes, but may take longer to receive estimates.

- Insurance Brokers: Can help you compare quotes from multiple insurance companies to find the best coverage options.

- Phone Quotes: Contacting insurance companies directly over the phone can also help you get accurate estimates based on your needs.

Factors Affecting Car Insurance Estimates

When it comes to determining car insurance estimates, several factors come into play. These factors can greatly influence the cost of your car insurance premium. Let's explore some of the common factors that affect car insurance estimates.

Age

Age is a significant factor that insurance companies consider when calculating car insurance estimates. Younger drivers, especially those under 25, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving Record

Your driving record plays a crucial role in determining your car insurance estimate. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or speeding tickets can result in higher costs.

Location

Where you live can also impact your car insurance estimate. Urban areas with higher crime rates or heavy traffic congestion may lead to higher premiums compared to rural areas with lower incidences of accidents and theft.

Type of Coverage

The type of coverage you choose for your car insurance can significantly influence the estimate. Opting for comprehensive coverage that includes protection against theft, vandalism, and natural disasters will result in a higher premium compared to basic liability coverage.

Vehicle Model

The make and model of your vehicle can also affect your car insurance estimate. Expensive or high-performance cars may cost more to insure due to higher repair or replacement costs in case of an accident.

Annual Mileage

The number of miles you drive annually can impact your car insurance estimate. Drivers who commute long distances or frequently use their vehicles are considered higher risk and may face higher premiums compared to those who drive less frequently.

Deductible Amount

The deductible amount you choose can influence your car insurance estimate. Opting for a higher deductible means you'll pay more out of pocket in case of a claim but may lead to lower premiums, while a lower deductible results in higher premiums but less upfront cost in case of an accident.

Tips for Lowering Car Insurance Estimates

Lowering your car insurance estimates can help you save money while still getting the coverage you need. Here are some effective strategies to reduce your car insurance costs:

Bundle Your Policies

Many insurance companies offer discounts if you bundle your car insurance with other policies, such as home or renters insurance. By combining multiple policies with the same insurer, you can often get a lower overall premium.

Improve Your Driving Habits

Safe driving habits can lead to lower car insurance estimates. By avoiding accidents and traffic violations, you can demonstrate to insurers that you are a responsible driver, which may result in lower premiums. Consider taking defensive driving courses to improve your skills and potentially qualify for additional discounts.

Compare Quotes from Different Insurers

One of the most effective ways to lower your car insurance estimates is to shop around and compare quotes from multiple insurers. Rates can vary significantly between companies, so it's important to explore your options and find the best deal.

Consider factors like coverage limits, deductibles, and discounts when comparing quotes to ensure you're getting the most value for your money.

Last Recap

Wrapping up our discussion on car insurance estimates, it's evident that being informed and proactive can make a significant difference in managing your insurance costs. Whether you're a seasoned driver or a novice on the road, taking the time to explore your options and understand the factors at play can lead to more favorable estimates and overall savings in the long run.

Detailed FAQs

What is a car insurance estimate?

A car insurance estimate is an approximation of the cost of insuring your vehicle based on various factors such as your driving history, location, and the type of coverage you choose.

How can I lower my car insurance estimate?

You can lower your car insurance estimate by bundling policies, improving your driving record, opting for a higher deductible, and comparing quotes from different insurers to find the best deal.

What factors influence car insurance estimates?

Factors like age, driving record, location, type of coverage, and even the make and model of your vehicle can impact your car insurance estimate.