When it comes to ensuring a stable financial future for parents and their children, life insurance plays a pivotal role. This article delves into the importance of life insurance for parents, explores the factors to consider when choosing the right policy, highlights the benefits it offers, and guides you through the steps of purchasing the most suitable coverage.

Importance of Life Insurance for Parents

Life insurance is a crucial financial tool for parents as it provides a safety net to protect their families in case of unexpected events. It ensures that children and other dependents are financially secure even if something were to happen to the parents.

Protection for the Financial Future

Life insurance can protect the financial future of parents by providing a lump sum payment to cover expenses such as mortgage payments, children's education, and daily living costs. This ensures that the family can maintain their standard of living even after the loss of a parent.

Different Types of Life Insurance Policies

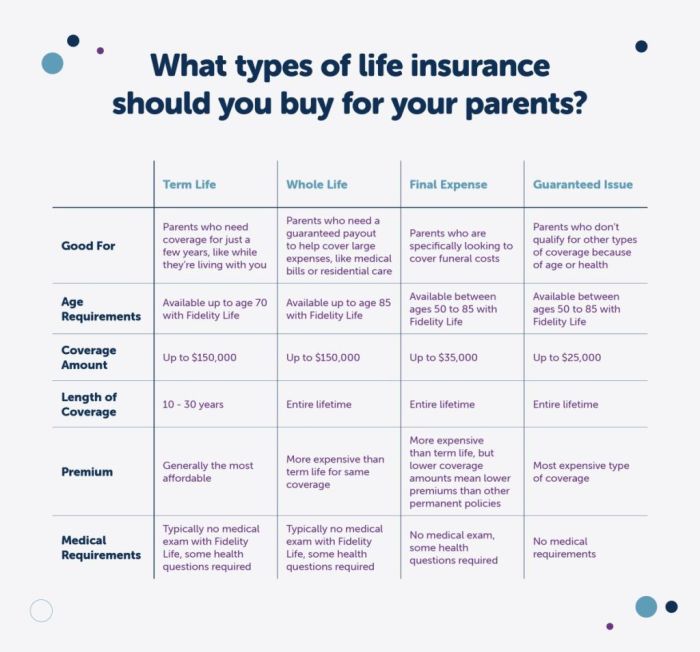

- Term Life Insurance: Offers coverage for a specific term, usually 10-30 years, with lower premiums compared to other types of life insurance.

- Whole Life Insurance: Provides coverage for the entire life of the insured and includes a savings component that grows over time.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits, allowing policyholders to adjust coverage as needed.

Factors to Consider When Choosing Life Insurance for Parents

When selecting a life insurance policy for parents, there are several key factors that need to be considered to ensure the right coverage for their needs.

Term Life Insurance vs. Whole Life Insurance

- Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. It is more affordable and offers a higher coverage amount for a lower premium.

- Whole life insurance, on the other hand, provides coverage for the entire life of the insured. It also includes a cash value component that can be used as an investment over time.

- Parents should consider their budget, coverage needs, and long-term financial goals when choosing between term and whole life insurance.

Impact of Age and Health on Life Insurance Coverage

- The age of parents plays a significant role in determining the cost of life insurance. Younger parents generally pay lower premiums compared to older parents.

- Health conditions can also impact the cost and availability of life insurance coverage. Parents with pre-existing medical conditions may face higher premiums or limited coverage options.

- It is essential for parents to undergo a thorough medical evaluation and disclose any health issues to insurance providers to ensure they receive the most suitable coverage.

Benefits of Life Insurance for Parents

Life insurance for parents offers a range of benefits that can provide peace of mind and financial security for the family in times of need. In the event of a parent's passing, life insurance can play a crucial role in ensuring that their children are taken care of financially.

Financial Security for Children

Life insurance serves as a safety net for children in case of a parent's untimely death. By providing a lump sum payout, life insurance can help cover essential expenses and maintain a certain standard of living for the family

- Life insurance payouts can cover outstanding mortgage payments, ensuring that the family home is not at risk of being lost.

- Education costs, such as tuition fees and living expenses, can be covered by life insurance proceeds, ensuring that children can continue their studies without financial constraints.

- Any outstanding debts, such as loans or credit card balances, can be settled using the funds from a life insurance policy, preventing financial burdens from falling on the surviving family members.

Steps to Take When Purchasing Life Insurance for Parents

When it comes to purchasing life insurance for parents, there are several important steps to consider to ensure you are making the right decision that fits your family's needs.

Evaluating Insurance Needs and Determining Coverage Amount

Before purchasing a life insurance policy for parents, it is crucial to evaluate your family's financial needs and determine the appropriate coverage amount. Consider factors such as outstanding debts, mortgage payments, future education expenses, and any other financial obligations that would need to be covered in the event of a parent's passing.

Designing a Checklist for Parents to Follow When Researching and Comparing Policies

Creating a checklist can help parents stay organized and make informed decisions when researching and comparing life insurance policies. Some key items to include in the checklist are:

- Identifying the financial needs of the family

- Researching different types of life insurance policies

- Comparing quotes from multiple insurance providers

- Reviewing the reputation and financial stability of the insurance company

- Understanding the policy terms and conditions

- Consulting with a financial advisor or insurance agent for guidance

Importance of Regularly Reviewing and Updating Life Insurance Policies

It is essential for parents to regularly review and update their life insurance policies as circumstances change. Life events such as marriage, the birth of a child, buying a home, or changing jobs can impact the amount of coverage needed.

By reviewing and updating policies, parents can ensure that their family's financial security is protected.

Last Word

In conclusion, life insurance for parents is not just a financial safety net but a way to provide peace of mind and security for your loved ones. By understanding the significance of this investment, you can take proactive steps to safeguard your family's future.

FAQ Corner

What is the importance of life insurance for parents?

Life insurance for parents is crucial as it provides financial security and peace of mind in the event of unexpected circumstances.

How does life insurance benefit children when a parent passes away?

Life insurance ensures that children are financially taken care of by providing a safety net for their future needs.

What factors should parents consider when choosing a life insurance policy?

Parents should consider factors such as coverage amount, premium costs, and the type of policy that best suits their needs.

Why is it important to review and update life insurance policies regularly?

Regularly reviewing and updating life insurance policies ensures that coverage aligns with changing circumstances and needs.