Delving into the realm of private health insurance opens up a world of possibilities for individuals seeking comprehensive healthcare coverage. With a myriad of plans and providers to choose from, finding the best private health insurance is a crucial decision that requires careful consideration and research.

Let's embark on this journey to uncover the top choices in private health insurance and what sets them apart.

As we navigate through the intricate landscape of private health insurance, we'll uncover key insights and essential information to help you make informed decisions about your healthcare needs.

Introduction to Private Health Insurance

Private health insurance refers to coverage individuals purchase from a private insurance company to help cover medical expenses. While public health insurance programs exist in many countries, private health insurance offers additional benefits and options for those seeking more comprehensive coverage.Private health insurance is important as it provides individuals with access to a wider range of healthcare services, shorter wait times for treatments, and more control over their healthcare choices.

Having private health insurance can offer peace of mind knowing that you have financial protection in case of unexpected medical emergencies.

Benefits of Private Health Insurance Coverage

- Access to a wider network of healthcare providers and specialists.

- Shorter wait times for elective surgeries and specialist appointments.

- Coverage for additional services not included in public health insurance plans, such as dental and vision care.

- Options for private hospital rooms and amenities during hospital stays.

- Flexibility to choose your preferred healthcare provider and treatment options.

Types of Private Health Insurance Plans

Private health insurance plans come in various types to cater to different needs and preferences. Three common types are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

Health Maintenance Organizations (HMOs)

HMO plans typically require members to choose a primary care physician and get referrals to see specialists. These plans often have lower out-of-pocket costs but limit the choice of healthcare providers.

- Advantages:

- Lower out-of-pocket costs

- Comprehensive coverage for preventive care

- Disadvantages:

- Limited choice of healthcare providers

- Need for referrals to see specialists

Preferred Provider Organizations (PPOs)

PPO plans offer more flexibility in choosing healthcare providers without the need for referrals. While they have a broader network of providers, costs can be higher compared to HMOs.

- Advantages:

- Greater provider choice

- No referrals required for specialists

- Disadvantages:

- Higher out-of-pocket costs

- May incur fees for out-of-network care

Exclusive Provider Organizations (EPOs)

EPO plans combine aspects of both HMOs and PPOs by offering a network of providers like an HMO but without requiring referrals for specialists. However, EPO plans do not cover out-of-network care except in emergencies.

- Advantages:

- No need for referrals to see specialists

- Potentially lower costs compared to PPOs

- Disadvantages:

- Strict network restrictions

- No out-of-network coverage

Factors to Consider When Choosing a Private Health Insurance Plan

When choosing a private health insurance plan, there are several key factors that individuals should consider to ensure they select the best plan for their needs. Factors such as coverage, cost, network, and benefits play a crucial role in decision-making.

Coverage

- Consider what medical services are covered by the plan, including hospital stays, doctor visits, prescription drugs, and preventive care.

- Check if the plan includes coverage for pre-existing conditions or specific treatments you may need in the future.

- Make sure that the plan provides coverage for emergencies and specialist consultations.

Cost

- Compare the monthly premiums, deductibles, and co-pays of different plans to find one that fits your budget.

- Consider the out-of-pocket maximum and the total cost of the plan over a year, including any additional costs beyond premiums.

- Take into account any potential discounts or subsidies you may be eligible for, such as employer contributions or government assistance.

Network

- Check if your preferred doctors, hospitals, and healthcare providers are included in the plan's network to ensure you can receive care from them.

- Consider the size and accessibility of the network, especially if you live in a rural area or travel frequently.

- Understand the referral process and restrictions on seeing out-of-network providers, if applicable.

Benefits

- Review the additional benefits offered by the plan, such as coverage for vision and dental care, mental health services, or alternative therapies.

- Consider if the plan includes wellness programs, telemedicine services, or prescription drug coverage that align with your healthcare needs.

- Evaluate any restrictions or limitations on benefits, such as annual visit caps or waiting periods for certain services.

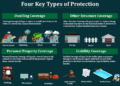

Coverage and Benefits of Private Health Insurance

Private health insurance offers a range of coverage and benefits beyond what is typically provided by government-funded healthcare programs. Understanding these benefits is essential when choosing a plan that meets your healthcare needs.

Common Medical Services Covered

Private health insurance plans commonly cover a variety of medical services, including:

- Hospitalization

- Doctor's visits

- Prescription medications

- Diagnostic tests

- Surgery

In-Network vs. Out-of-Network Coverage

In-network coverage refers to services provided by healthcare providers who have a contract with your insurance company

Additional Benefits

In addition to standard medical services, private health insurance plans may offer additional benefits such as:

- Dental coverage for routine cleanings, fillings, and other dental procedures

- Vision coverage for eye exams, glasses, and contact lenses

- Mental health coverage for therapy, counseling, and psychiatric services

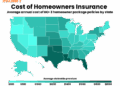

Cost and Affordability of Private Health Insurance

Private health insurance plans come with various costs that individuals need to consider when choosing a plan. These costs can include premiums, deductibles, copayments, and other out-of-pocket expenses. Understanding the factors that impact these costs can help individuals manage and reduce their private health insurance expenses.

Breakdown of Costs Associated with Private Health Insurance Plans

- Premiums: The premium is the amount paid to the insurance company on a regular basis to maintain coverage. Premiums can vary based on factors such as age, location, and type of plan.

- Deductibles: A deductible is the amount that the insured individual must pay out of pocket before the insurance company starts covering expenses. Higher deductibles typically result in lower premiums.

- Copayments: Copayments are fixed amounts that the insured individual pays for covered services, such as doctor visits or prescription medications. Copayments can vary depending on the plan.

- Out-of-Pocket Maximum: This is the maximum amount that the insured individual is required to pay for covered services during a policy period. Once this limit is reached, the insurance company covers all additional costs.

Factors Impacting the Cost of Premiums, Deductibles, and Copayments

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Location: The cost of healthcare can vary by region, impacting the overall cost of insurance plans.

- Type of Plan: The coverage and benefits offered by different plans can impact the cost of premiums, deductibles, and copayments.

- Health Status: Individuals with pre-existing conditions may face higher premiums and out-of-pocket costs.

Strategies for Managing and Reducing Private Health Insurance Costs

- Compare Plans: Take the time to compare different private health insurance plans to find one that offers the best value for your needs.

- Utilize Preventive Services: Taking advantage of preventive services can help you avoid costly medical treatments in the future.

- Consider Health Savings Accounts (HSAs): HSAs allow you to save money tax-free for medical expenses, helping you manage out-of-pocket costs.

- Negotiate Costs: If you receive a medical bill that seems high, don't hesitate to negotiate with healthcare providers or insurance companies for lower rates.

Enrollment Process and Eligibility Requirements

When it comes to enrolling in a private health insurance plan, there are several steps you need to follow to ensure you get the coverage you need. Understanding the eligibility requirements is crucial in determining if you qualify for purchasing private health insurance.

Additionally, knowing about special enrollment periods and deadlines for signing up can help you make informed decisions about your healthcare coverage.

Enrollment Process

- Research and Compare Plans: Start by researching different private health insurance plans available in your area. Compare coverage, benefits, and costs to find the plan that best fits your needs.

- Choose a Plan: Once you've compared different plans, choose the one that offers the coverage you need at a price you can afford.

- Submit Application: Fill out the application form for the selected plan and submit it along with any required documentation.

- Pay Premium: After your application is approved, you will need to pay the premium to activate your coverage.

Eligibility Requirements

- Residency Status: In most cases, you need to be a legal resident of the country where you are purchasing private health insurance.

- Age Requirement: Some private health insurance plans have age restrictions, so make sure you meet the age criteria for the plan you are interested in.

- Income Level: Your income level may also play a role in determining your eligibility for certain private health insurance plans, especially those with subsidies.

Special Enrollment Periods and Deadlines

- Qualifying Life Events: If you experience a qualifying life event such as losing your job or getting married, you may be eligible for a special enrollment period to sign up for private health insurance outside of the regular enrollment period.

- Open Enrollment Period: The open enrollment period is the designated time each year when you can sign up for private health insurance or make changes to your existing plan. Missing this deadline may result in having to wait until the next enrollment period.

Choosing the Best Private Health Insurance Provider

When it comes to selecting a private health insurance provider, it is crucial to consider factors such as reputation, customer reviews, and overall reliability. Here, we will explore how to identify reputable insurance companies and make an informed decision.

Identify Reputable Private Health Insurance Providers

- Research well-known insurance companies that specialize in private health coverage.

- Check for accreditation and ratings from reputable organizations such as J.D. Power or A.M. Best.

- Ask for recommendations from friends, family, or healthcare professionals.

Compare Customer Reviews and Ratings

- Read online reviews and testimonials from current or past policyholders.

- Look for feedback on customer service, claims processing, and overall satisfaction.

- Consider ratings from consumer advocacy websites like Consumer Reports or BBB.

Research and Select a Reliable Insurance Provider

- Review the provider's network of healthcare providers and facilities to ensure they meet your needs.

- Compare coverage options, deductibles, co-pays, and out-of-pocket expenses.

- Contact the insurance company directly to ask questions and clarify any doubts.

Concluding Remarks

In conclusion, the quest for the best private health insurance is a personal journey that hinges on individual preferences, needs, and financial considerations. By exploring the diverse options available and understanding the nuances of each plan, you can confidently select a provider that aligns with your healthcare goals.

Whether it's coverage, cost, or benefits, choosing the best private health insurance is an empowering decision that ensures peace of mind and security for the future.

Expert Answers

What are the advantages of private health insurance?

Private health insurance offers a wider range of coverage options, shorter wait times for medical services, and access to a network of top-tier healthcare providers.

How do I choose the best private health insurance plan?

Consider factors like coverage extent, network providers, out-of-pocket costs, and additional benefits like dental and vision coverage to find the best plan for your needs.

Can I switch private health insurance providers?

Yes, you can switch providers during open enrollment periods or qualifying life events to find a plan that better suits your changing healthcare needs.