Delving into the realm of final expense insurance quotes, this introductory paragraph aims to pique the interest of readers with valuable insights.

Exploring the nuances of final expense insurance and shedding light on its significance in financial planning.

Understanding Final Expense Insurance

Final expense insurance is a type of life insurance policy specifically designed to cover end-of-life expenses, such as funeral costs, medical bills, and other debts left behind by the deceased. It is also known as burial insurance or funeral insurance.

Purpose of Final Expense Insurance

Final expense insurance serves the purpose of providing financial assistance to the family members or beneficiaries of the policyholder to cover the costs associated with the funeral and other end-of-life expenses. It helps alleviate the financial burden on loved ones during a difficult time.

Who Typically Purchases Final Expense Insurance

Individuals who are concerned about leaving their loved ones with the financial responsibility of their funeral and other final expenses often purchase final expense insurance. This type of policy is generally popular among senior citizens or those with health conditions that may prevent them from qualifying for traditional life insurance.

Benefits of Final Expense Insurance

Final expense insurance offers several benefits that can provide peace of mind and financial security for policyholders and their loved ones.

1. Financial Protection

- Final expense insurance helps cover end-of-life expenses, such as funeral costs, medical bills, and outstanding debts, relieving the financial burden on family members.

- Unlike traditional life insurance, final expense insurance payouts are typically processed quickly, ensuring immediate financial assistance during a difficult time.

2. Guaranteed Approval

- Final expense insurance policies often have simplified underwriting processes, making them accessible to individuals who may have health issues or are older and may not qualify for other types of insurance.

- Some final expense insurance plans offer guaranteed acceptance, meaning applicants cannot be turned down due to their health status.

3. Fixed Premiums

- Final expense insurance policies come with fixed premiums that do not increase with age, ensuring predictability and affordability for policyholders.

- Policyholders can choose the coverage amount that best fits their needs and budget, making it easier to plan for future expenses.

Obtaining a Quote for Final Expense Insurance

When it comes to final expense insurance, getting a quote is an essential step in finding the right coverage for you or your loved ones. The quote will give you an estimate of the cost and benefits of the policy, helping you make an informed decision.

Here's how you can go about obtaining a quote for final expense insurance:

Process of Getting a Final Expense Insurance Quote

To get a final expense insurance quote, you can start by reaching out to insurance providers directly or working with an independent insurance agent. They will gather information about your age, health status, and coverage preferences to generate a personalized quote for you.

Some insurance companies may offer online tools that allow you to get a quick quote by entering basic information.

Tips on Comparing Quotes from Different Insurance Providers

- Request quotes from multiple insurance providers to compare costs and coverage options.

- Consider the reputation and financial stability of the insurance company.

- Look for any additional benefits or riders included in the policy.

- Pay attention to any exclusions or limitations that may affect your coverage.

- Ask about any discounts or incentives that could lower the cost of the policy.

Factors Impacting the Final Expense Insurance Quote

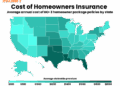

Factors such as age, health status, coverage amount, and the type of policy can impact the final expense insurance quote.

Age

Younger individuals may receive lower quotes compared to older individuals.

Health Status

Pre-existing medical conditions may result in higher premiums.

Coverage Amount

Higher coverage amounts typically lead to higher quotes.

Type of Policy

The type of final expense insurance policy chosen, such as burial insurance or pre-need insurance, can influence the quote.

Coverage Options and Limitations

When it comes to final expense insurance, there are a few coverage options to consider based on your needs and budget. It's important to understand these options as well as any limitations or exclusions that may apply to the coverage.

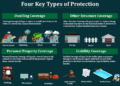

Coverage Options

- Standard Coverage: This provides a set benefit amount to cover funeral expenses, medical bills, and other end-of-life costs.

- Modified Coverage: This option may have a waiting period before full benefits are available, often chosen by those with pre-existing health conditions.

- Guaranteed Issue Coverage: No medical exams are required for this coverage, making it accessible to those with health issues.

Limitations and Exclusions

- Pre-existing Conditions: Some policies may not cover certain pre-existing health conditions for a specified period.

- Accidental Death Exclusions: In some cases, accidental deaths may not be covered under the policy.

- Policy Lapse: If premiums are not paid, the policy may lapse, leading to a loss of coverage.

Choosing the Right Coverage Amount

When selecting a coverage amount for final expense insurance, consider factors such as your age, health status, and anticipated end-of-life expenses. It's important to strike a balance between ensuring your loved ones are not burdened with costs and paying affordable premiums.

Final Thoughts

Wrapping up our discussion on final expense insurance quotes, we hope this guide has provided clarity and understanding on this crucial aspect of financial security.

Detailed FAQs

What is final expense insurance?

Final expense insurance is a type of insurance policy specifically designed to cover end-of-life expenses, such as funeral costs and medical bills.

Who typically purchases final expense insurance?

Final expense insurance is commonly purchased by individuals who want to ensure that their loved ones are not burdened with funeral expenses and other debts after their passing.

How can I compare quotes from different insurance providers?

When comparing quotes, make sure to consider the coverage amount, premium costs, and any additional benefits offered by each provider to make an informed decision.

What factors can impact the final expense insurance quote?

Factors such as age, health status, and the chosen coverage amount can impact the final expense insurance quote, with older individuals and those with health issues typically paying higher premiums.